summary podcast

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and ChatGPT to summarize the information in this week’s news links:

Governmental and Institutional Adoption of Bitcoin

Governments and institutions are increasingly recognizing Bitcoin’s strategic value, with several nations exploring the creation of national Bitcoin reserves. Binance CEO Richard Teng disclosed that multiple governments and sovereign wealth funds have sought guidance on establishing crypto regulations and Bitcoin reserves, inspired by the U.S. initiative to form a Strategic Bitcoin Reserve using seized assets. This shift is prompting Binance to consider a global headquarters to engage in policy shaping, moving away from its decentralized roots. Proposals like Newmarket Capital CEO Andrew Hohns’ “BitBonds” suggest innovative ways for governments, such as the U.S., to acquire Bitcoin while addressing national debt and providing tax-exempt exposure to citizens. Additionally, countries like Pakistan and Kyrgyzstan are partnering with Binance to develop crypto regulatory frameworks, signaling broader global acceptance. Institutional adoption is surging, with figures like Dr. Adam Back and Michael Saylor noting increased participation from traditional institutions, driven by regulatory milestones like spot Bitcoin ETF approvals, which reduce friction and boost confidence.

Governments and institutions are increasingly recognizing Bitcoin’s strategic value, with several nations exploring the creation of national Bitcoin reserves. Binance CEO Richard Teng disclosed that multiple governments and sovereign wealth funds have sought guidance on establishing crypto regulations and Bitcoin reserves, inspired by the U.S. initiative to form a Strategic Bitcoin Reserve using seized assets. This shift is prompting Binance to consider a global headquarters to engage in policy shaping, moving away from its decentralized roots. Proposals like Newmarket Capital CEO Andrew Hohns’ “BitBonds” suggest innovative ways for governments, such as the U.S., to acquire Bitcoin while addressing national debt and providing tax-exempt exposure to citizens. Additionally, countries like Pakistan and Kyrgyzstan are partnering with Binance to develop crypto regulatory frameworks, signaling broader global acceptance. Institutional adoption is surging, with figures like Dr. Adam Back and Michael Saylor noting increased participation from traditional institutions, driven by regulatory milestones like spot Bitcoin ETF approvals, which reduce friction and boost confidence.

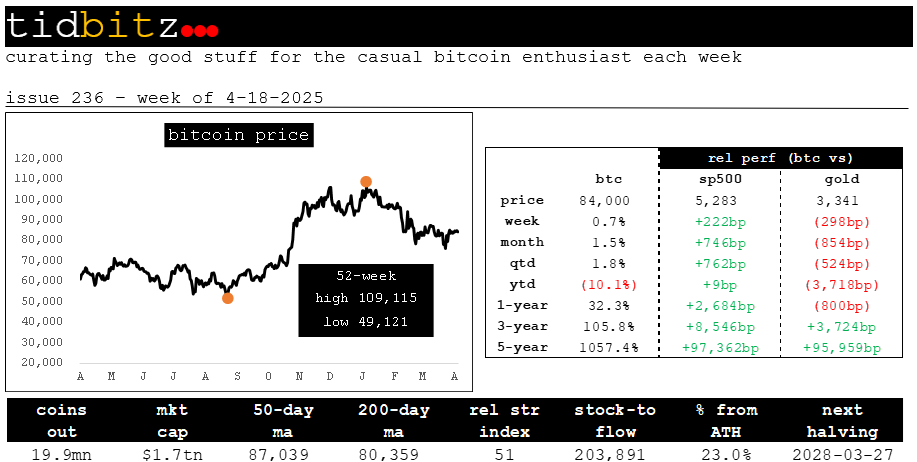

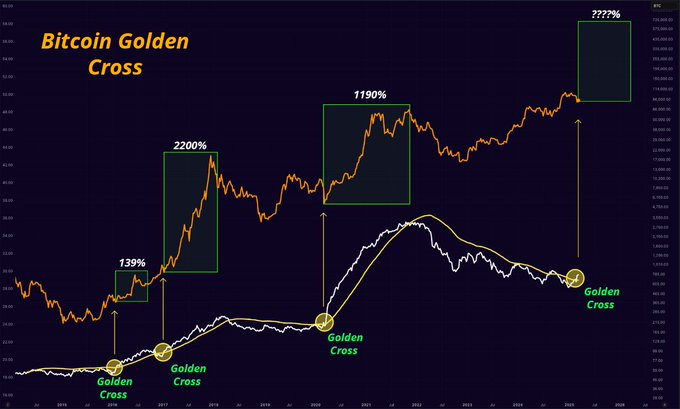

Price Predictions and Market Outlook

Analysts are overwhelmingly bullish on Bitcoin’s price trajectory, citing historical patterns, macroeconomic factors, and growing adoption. Benjamin Cowen predicts Bitcoin could reach $120,000–$150,000 in a right-translated cycle, with a potential peak of $200,000 under ideal conditions. Timothy Peterson forecasts $138,000 within three months, while Pantera Capital’s Dan Morehead projects an ambitious $745,000, suggesting Bitcoin has achieved “escape velocity.” Michael Saylor envisions multi-million-dollar valuations as MicroStrategy continues accumulating Bitcoin. Macroeconomic influences, such as U.S. dollar weakness, inflation, and geopolitical events like tariffs, are seen as catalysts for price surges, with Jordy Visser noting that tariff clarity or liquidity injections could push Bitcoin to new highs by late 2025. The Bitcoin halving cycle remains a key driver, amplified by the growing availability of financial instruments like ETFs, which facilitate investor participation.

Analysts are overwhelmingly bullish on Bitcoin’s price trajectory, citing historical patterns, macroeconomic factors, and growing adoption. Benjamin Cowen predicts Bitcoin could reach $120,000–$150,000 in a right-translated cycle, with a potential peak of $200,000 under ideal conditions. Timothy Peterson forecasts $138,000 within three months, while Pantera Capital’s Dan Morehead projects an ambitious $745,000, suggesting Bitcoin has achieved “escape velocity.” Michael Saylor envisions multi-million-dollar valuations as MicroStrategy continues accumulating Bitcoin. Macroeconomic influences, such as U.S. dollar weakness, inflation, and geopolitical events like tariffs, are seen as catalysts for price surges, with Jordy Visser noting that tariff clarity or liquidity injections could push Bitcoin to new highs by late 2025. The Bitcoin halving cycle remains a key driver, amplified by the growing availability of financial instruments like ETFs, which facilitate investor participation.

The "Bitcoin Standard" and Infrastructure Developments

The concept of a “Bitcoin standard” is gaining traction, with Michael Saylor advocating for companies to adopt Bitcoin as a primary reserve asset due to its superior returns compared to traditional assets. He argues this shift enhances capital efficiency and shareholder value, with MicroStrategy leveraging Bitcoin through innovative securities like convertible bonds. Saylor emphasizes Bitcoin’s role as a store of value over a medium of exchange, comparing it to gold and real estate. Meanwhile, infrastructure advancements are improving Bitcoin’s accessibility, with Charles Schwab aiming to offer spot Bitcoin trading by April 2026 and Blockstream developing layer-2 solutions like Lightning and Liquid for payments and financial instrument trading. The collapse of FTX has heightened focus on secure custody, prompting investments in institutional-grade custodians like Kamu. These developments, alongside Bitcoin’s decentralized ethos, as highlighted by Jordy Visser, underscore its potential to democratize wealth creation and offer hope amid economic challenges.

The concept of a “Bitcoin standard” is gaining traction, with Michael Saylor advocating for companies to adopt Bitcoin as a primary reserve asset due to its superior returns compared to traditional assets. He argues this shift enhances capital efficiency and shareholder value, with MicroStrategy leveraging Bitcoin through innovative securities like convertible bonds. Saylor emphasizes Bitcoin’s role as a store of value over a medium of exchange, comparing it to gold and real estate. Meanwhile, infrastructure advancements are improving Bitcoin’s accessibility, with Charles Schwab aiming to offer spot Bitcoin trading by April 2026 and Blockstream developing layer-2 solutions like Lightning and Liquid for payments and financial instrument trading. The collapse of FTX has heightened focus on secure custody, prompting investments in institutional-grade custodians like Kamu. These developments, alongside Bitcoin’s decentralized ethos, as highlighted by Jordy Visser, underscore its potential to democratize wealth creation and offer hope amid economic challenges.

Binance Advising Multiple Governments On Strategic Bitcoin Reserve.

https://bitcoinmagazine.com/news/binance-advising-multiple-governments-on-strategic-bitcoin-reserve

How Trump’s Bitcoin Policies Are Making The U.S. A Crypto Superpower.

https://www.forbes.com/sites/digital-assets/2025/04/18/how-trumps-bitcoin-policies-are-making-the-us-a-crypto-superpower/

Bitcoin can reach $138K in 3 months as macro odds see BTC price upside.

https://cointelegraph.com/news/bitcoin-can-reach-138k-in-3-months-macro-btc-price-upside

Bitcoin Could Rip by 137% in a “Perfect Scenario,” According to Analyst Benjamin Cowen – Here’s His Outlook.

https://dailyhodl.com/2025/04/19/bitcoin-could-rip-by-137-in-a-perfect-scenario-according-to-analyst-benjamin-cowen-heres-his-outlook/

Michael Saylor calls for $13 million BTC — Pantera CEO says $745K is “realistic.”

https://www.thestreet.com/crypto/markets/michael-saylor-calls-for-13-million-btc-pantera-ceo-says-745k-is-realistic

When gold price hits new highs, history shows “Bitcoin follows” within 150 days — Analyst.

https://cointelegraph.com/news/when-gold-price-hits-new-highs-history-shows-bitcoin-follows-within-150-days-analyst

Charles Schwab CEO eyes spot Bitcoin trading by April 2026.

https://cointelegraph.com/news/charles-schwab-eyes-spot-bitcoin-trading-2026

This spa’s water is heated by bitcoin mining.

https://www.technologyreview.com/2025/04/18/1114464/bitcoin-mining-heat-spas-water-climate-warming/