summary podcast

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and ChatGPT to summarize the information in this week’s news links:

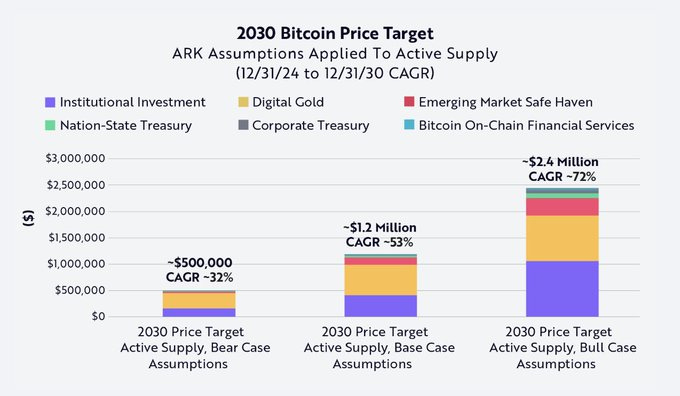

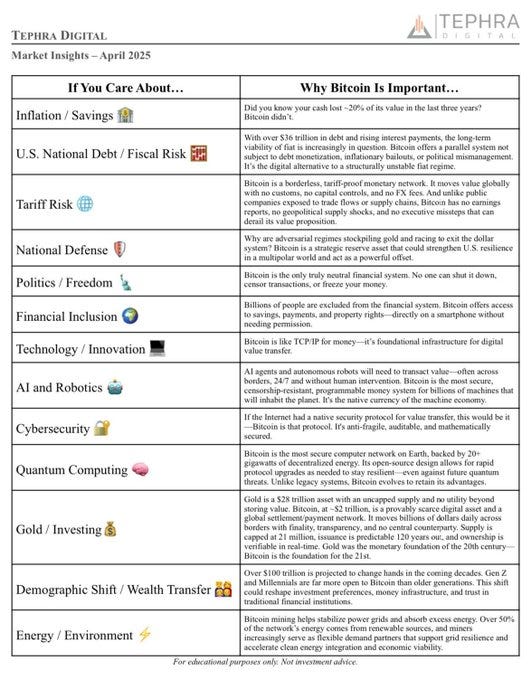

Bitcoin Price Targets and Institutional Adoption Surge

ARK Invest has dramatically increased its 2030 Bitcoin bull case price target to $2.4 million, driven by Bitcoin’s Total Addressable Market (TAM), adoption trends, and limited supply dynamics. Institutional demand is a key catalyst, with BlackRock’s Bitcoin ETF projected to become the world’s largest and Bitcoin ETFs seeing significant inflows, such as $912 million recently, pushing Bitcoin’s price above $94,000. Publicly traded companies are increasingly adopting Bitcoin as a treasury asset, following MicroStrategy’s lead, which holds 538,200 BTC as of April 2025. Other firms like Japan’s Metaplanet and HK Asia Holdings are also accumulating Bitcoin, while a new firm, Twenty One, backed by major players like Cantor and SoftBank, aims to aggressively acquire Bitcoin and build related products. This institutional embrace is seen as a net positive, enhancing liquidity and network security, though concerns linger about potential centralization risks.

ARK Invest has dramatically increased its 2030 Bitcoin bull case price target to $2.4 million, driven by Bitcoin’s Total Addressable Market (TAM), adoption trends, and limited supply dynamics. Institutional demand is a key catalyst, with BlackRock’s Bitcoin ETF projected to become the world’s largest and Bitcoin ETFs seeing significant inflows, such as $912 million recently, pushing Bitcoin’s price above $94,000. Publicly traded companies are increasingly adopting Bitcoin as a treasury asset, following MicroStrategy’s lead, which holds 538,200 BTC as of April 2025. Other firms like Japan’s Metaplanet and HK Asia Holdings are also accumulating Bitcoin, while a new firm, Twenty One, backed by major players like Cantor and SoftBank, aims to aggressively acquire Bitcoin and build related products. This institutional embrace is seen as a net positive, enhancing liquidity and network security, though concerns linger about potential centralization risks.

Bitcoin as Digital Gold and Emerging Market Potential

Bitcoin is gaining traction as a “digital gold,” with ARK Invest suggesting its store-of-value potential could capture over a third of its $2.4 million valuation by taking 60% of gold’s $18 trillion market cap. Unlike gold, which Saifedean Ammous argues lacks monetary premium due to its industrial and jewelry uses, Bitcoin’s fixed supply and transparency position it as a superior hedge against inflation. Emerging markets are a significant growth driver, with ARK noting their potential to contribute 13.5% to Bitcoin’s valuation due to its ability to protect wealth in economies facing currency devaluation. Early adoption in regions like Latin America, Asia, and Africa, often by those distrustful of traditional financial systems, underscores Bitcoin’s appeal to the unbanked and its role in decentralizing global capital.

Bitcoin is gaining traction as a “digital gold,” with ARK Invest suggesting its store-of-value potential could capture over a third of its $2.4 million valuation by taking 60% of gold’s $18 trillion market cap. Unlike gold, which Saifedean Ammous argues lacks monetary premium due to its industrial and jewelry uses, Bitcoin’s fixed supply and transparency position it as a superior hedge against inflation. Emerging markets are a significant growth driver, with ARK noting their potential to contribute 13.5% to Bitcoin’s valuation due to its ability to protect wealth in economies facing currency devaluation. Early adoption in regions like Latin America, Asia, and Africa, often by those distrustful of traditional financial systems, underscores Bitcoin’s appeal to the unbanked and its role in decentralizing global capital.

Political Shifts and Bitcoin’s Ideological Rise

A pro-Bitcoin political climate, particularly in the U.S. under the current administration, is fostering optimism, with figures like Donald Trump and his family actively supporting the asset. El Salvador’s Bitcoin reserve strategy and education programs under President Bukele serve as a global model, while U.S. sanctions and tariffs may accelerate a shift toward decentralized finance. Bitcoin’s fixed supply is hailed as its core innovation, enabling a separation of money from state control—a concept likened to a “sly workaround” in Austrian economics. The “Bitcoin mafia,” a resilient community of long-term holders, is poised to become future capital allocators, driven by a moral framework for saving and investing. However, challenges like “current thingism”—a focus on short-term market noise—and potential regulatory hurdles to self-custody could impede broader adoption, though the overall sentiment remains bullish.

A pro-Bitcoin political climate, particularly in the U.S. under the current administration, is fostering optimism, with figures like Donald Trump and his family actively supporting the asset. El Salvador’s Bitcoin reserve strategy and education programs under President Bukele serve as a global model, while U.S. sanctions and tariffs may accelerate a shift toward decentralized finance. Bitcoin’s fixed supply is hailed as its core innovation, enabling a separation of money from state control—a concept likened to a “sly workaround” in Austrian economics. The “Bitcoin mafia,” a resilient community of long-term holders, is poised to become future capital allocators, driven by a moral framework for saving and investing. However, challenges like “current thingism”—a focus on short-term market noise—and potential regulatory hurdles to self-custody could impede broader adoption, though the overall sentiment remains bullish.

Bitcoin ETFs See $912 Million Inflows, Bitcoin Price Surges Above $94,000.

https://bitcoinmagazine.com/news/bitcoin-etfs-see-912-million-inflows-bitcoin-price-surges-above-94000

Bitcoin Rallies Above $90,000 to Extend Rebound to More Than 20%.

https://www.bloomberg.com/news/articles/2025-04-22/bitcoin-rallies-20-during-market-turmoil-to-diverge-from-tech

Bitcoin Is Decoupling—and It Doesn’t Care About Tariffs or Earnings Reports.

https://bitcoinmagazine.com/bitcoin-for-corporations/bitcoin-is-decoupling-doesnt-care-about-tariffs

ARK’s Price Target For Bitcoin In 2030

https://www.ark-invest.com/articles/valuation-models/arks-bitcoin-price-target-2030

Tether, SoftBank Group, and Jack Mallers Launch Twenty One, a Bitcoin-native Company, Through a Business Combination With Cantor Equity Partners.

https://www.businesswire.com/news/home/20250423962305/en/Tether-SoftBank-Group-and-Jack-Mallers-Launch-Twenty-One-a-Bitcoin-native-Company-Through-a-Business-Combination-With-Cantor-Equity-Partners

Federal Reserve Board announces the withdrawal of guidance for banks related to their crypto-asset and dollar token activities and related changes to its expectations for these activities.

https://www.federalreserve.gov/newsevents/pressreleases/bcreg20250424a.htm

Strategy Acquires 6,556 BTC and Now Holds 538,200 BTC.

https://www.strategy.com/press/strategy-acquires-6556-btc-and-now-holds-538200-btc_04-21-2025

Billionaire Jack Dorsey Says “A Lot Coming” to Block’s Self-Custody Bitcoin Wallet Next Month.

https://dailyhodl.com/2025/04/24/billionaire-jack-dorsey-says-a-lot-coming-to-blocks-self-custody-bitcoin-wallet-next-month/

Bitcoin supply on exchanges is falling “due to public company purchases” — Fidelity.

https://cointelegraph.com/news/bitcoin-supply-exchanges-falling-public-company-purchases-fidelity

Jameson Lopp: Bitcoin Is Not A Finished Project.

https://bitcoinmagazine.com/technical/jameson-lopp-bitcoin-is-not-a-finished-project

media

Podcast. The Bitcoin Matrix: Why 99% Aren’t Ready for $100M Bitcoin (But It’s Coming).

Bloomberg. Cantor, Tether, SoftBank Back New Bitcoin Firm.

Podcast. The Pomp Podcast: America Is Moving To Bitcoin Standard?! | Saifedean Ammous.

Unchained: Bitcoin, Not Crypto — Part I: In Search of a Finite Monetary Policy.

Bitcoin University. Bitcoin Going To $250,000 Soon?

Unchained. Twenty One Aims to Buy as Much Bitcoin as Possible. Can It Succeed?

Podcast. Archie Podcast: Max Keiser & Stacy Herbert: Bitcoin Evolution and Nation-State Adoption | S01 E001.

Podcast. Invest Like the Best: Investing at the Frontier with Matt Huang.

https://joincolossus.com/episode/investing-at-the-frontier/