summary podcast

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and ChatGPT to summarize the information in this week’s news links:

Increasing Institutional and Corporate Adoption of Bitcoin

The growing institutional and corporate embrace of Bitcoin marks a significant shift in its perception as a legitimate asset. Notable examples include Brown University's investment in BlackRock’s Bitcoin ETF and MicroStrategy’s aggressive accumulation of 553,555 BTC, recently bolstered by an additional 15,355 BTC purchase. MicroStrategy, under Michael Saylor’s leadership, has pioneered a strategy of raising funds through equity, convertible bonds, and innovative securities like "Strike" and "Strife" to acquire Bitcoin, effectively bridging traditional finance with the crypto ecosystem. This approach offers compliance, liquidity, and volatility advantages for institutional investors, with 13,000 institutions, including pension funds and sovereign wealth funds, holding its stock. Recent Federal Reserve guidance permitting banks to engage with Bitcoin further fuels speculation about the rise of "Bitcoin banks" and broader corporate adoption, positioning MicroStrategy as a model for others to follow.

The growing institutional and corporate embrace of Bitcoin marks a significant shift in its perception as a legitimate asset. Notable examples include Brown University's investment in BlackRock’s Bitcoin ETF and MicroStrategy’s aggressive accumulation of 553,555 BTC, recently bolstered by an additional 15,355 BTC purchase. MicroStrategy, under Michael Saylor’s leadership, has pioneered a strategy of raising funds through equity, convertible bonds, and innovative securities like "Strike" and "Strife" to acquire Bitcoin, effectively bridging traditional finance with the crypto ecosystem. This approach offers compliance, liquidity, and volatility advantages for institutional investors, with 13,000 institutions, including pension funds and sovereign wealth funds, holding its stock. Recent Federal Reserve guidance permitting banks to engage with Bitcoin further fuels speculation about the rise of "Bitcoin banks" and broader corporate adoption, positioning MicroStrategy as a model for others to follow.

Bitcoin as a Macro Asset and Store of Value

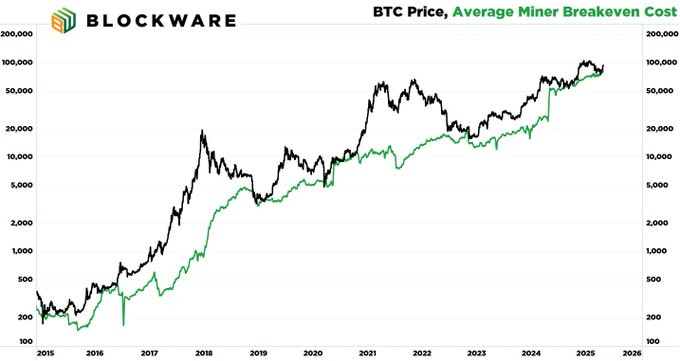

Bitcoin is increasingly viewed as a hedge against macroeconomic instability, fiat currency debasement, and the potential decline of the US dollar’s reserve status, driven by factors like rising tariffs, deglobalization, and ballooning national debt. Experts like Ray Dalio have long predicted such shifts, and Bitcoin’s price behavior now resembles gold more than tech stocks, reflecting its role as a store of value. Concepts like a "hard money soft money dual standard" and "Bit Bonds"—US Treasuries partially backed by Bitcoin—highlight its potential integration into financial systems, particularly at the municipal level. Bitcoin’s fixed 21-million-coin supply, transparency, and predictability contrast sharply with fiat currencies’ inflationary tendencies, making it a tool for individuals and institutions to safeguard wealth and assert financial sovereignty in a fragile global economy.

Bitcoin is increasingly viewed as a hedge against macroeconomic instability, fiat currency debasement, and the potential decline of the US dollar’s reserve status, driven by factors like rising tariffs, deglobalization, and ballooning national debt. Experts like Ray Dalio have long predicted such shifts, and Bitcoin’s price behavior now resembles gold more than tech stocks, reflecting its role as a store of value. Concepts like a "hard money soft money dual standard" and "Bit Bonds"—US Treasuries partially backed by Bitcoin—highlight its potential integration into financial systems, particularly at the municipal level. Bitcoin’s fixed 21-million-coin supply, transparency, and predictability contrast sharply with fiat currencies’ inflationary tendencies, making it a tool for individuals and institutions to safeguard wealth and assert financial sovereignty in a fragile global economy.

Financial Innovation, Challenges, and Individual Strategies

MicroStrategy’s creation of financial instruments like "Strike" and "Strife" caters to diverse investor risk profiles, aiming to attract fixed-income and institutional capital by securing credit ratings from agencies like Moody’s. This "Bitcoin securitization" could position MicroStrategy as the first investment-grade Bitcoin treasury company, though risks like trading below Net Asset Value or market saturation loom. Meanwhile, skepticism persists, as seen in Arizona’s rejection of a Bitcoin reserve bill and ongoing Bitcoin protocol debates. For individual investors, dollar cost averaging (DCA) remains a powerful strategy, exemplified by Saylor’s consistent purchases, offering a low-stress way to navigate Bitcoin’s volatility. As Bitcoin gains traction amid stablecoin adoption and political support, its role as a countermeasure to financial fragility grows, though regulatory and technical hurdles continue to shape its path forward.

MicroStrategy’s creation of financial instruments like "Strike" and "Strife" caters to diverse investor risk profiles, aiming to attract fixed-income and institutional capital by securing credit ratings from agencies like Moody’s. This "Bitcoin securitization" could position MicroStrategy as the first investment-grade Bitcoin treasury company, though risks like trading below Net Asset Value or market saturation loom. Meanwhile, skepticism persists, as seen in Arizona’s rejection of a Bitcoin reserve bill and ongoing Bitcoin protocol debates. For individual investors, dollar cost averaging (DCA) remains a powerful strategy, exemplified by Saylor’s consistent purchases, offering a low-stress way to navigate Bitcoin’s volatility. As Bitcoin gains traction amid stablecoin adoption and political support, its role as a countermeasure to financial fragility grows, though regulatory and technical hurdles continue to shape its path forward.

Bitcoin tops $97K as institutional demand and state reserves rise.

https://www.thestreet.com/crypto/markets/bitcoin-tops-97k-as-institutional-demand-and-state-reserves-rise

A New Era: The ₿itcoin-Backed Monetary System.

https://www.zerohedge.com/crypto/new-era-itcoin-backed-monetary-system

MicroStrategy doubles down on its bitcoin bet.

https://www.marketwatch.com/story/microstrategy-doubles-down-on-its-bitcoin-bet-5fad71df

Strategy Acquires 15,355 BTC and Now Holds 553,555 BTC.

https://www.strategy.com/press/strategy-acquires-15355-btc-now-holds-553555-btc_04-28-2025

Semler Scientific Announces Updated BTC & ATM Activity; Purchased Additional 165 BTC; Now Holds 3,467 BTC; YTD BTC Yield of 23.8%.

https://ir.semlerscientific.com/news-releases/news-release-details/semler-scientificr-announces-updated-btc-atm-activity-0

Brown University Bets on Bitcoin With Millions Worth of BlackRock ETF Shares.

https://decrypt.co/317714/brown-university-bitcoin-blackrock-etf

Arizona Governor Calls Crypto an “Untested Investment,” Vetoes Bitcoin Reserve Bill.

https://www.coindesk.com/policy/2025/05/03/arizona-governor-calls-crypto-an-untested-investment-vetoes-bitcoin-reserve-bill

Bitcoin Debate on Looser Data Limits Brings to Mind the Divisive Ordinals Controversy.

https://www.coindesk.com/tech/2025/04/30/bitcoin-debate-on-looser-data-limits-brings-to-mind-the-divisive-ordinals-controversy