summary podcast

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and ChatGPT to summarize the information in this week’s news links:

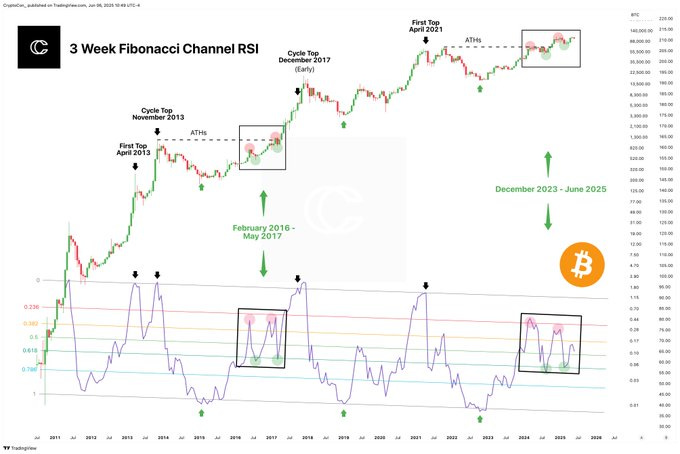

Bitcoin and Ethereum are experiencing a complex phase in the 2025 market, characterized by both bullish technical signals and cautionary macro indicators. Bitcoin has recovered from a multi-month slump and triggered a “Golden Cross” pattern, sparking projections of a 51% rally that could push its price toward $150,000 by year-end. However, conflicting signals, including bearish RSI divergences and the potential end of a bull cycle, have prompted warnings of a possible 50% correction. PlanB and other analysts maintain long-term bullishness, projecting valuations as high as $400,000–$1 million based on on-chain data and scarcity models. Ethereum, while showing relative strength in mid-2025, would require substantial gains to hit a new all-time high due to competition from other networks and previous volatility. Still, many believe both assets could remain resilient even if this cycle is nearing its final phase.

One major driver of cryptocurrency demand in 2025 is corporate and institutional adoption. Companies like MicroStrategy and MetaPlanet have pioneered aggressive treasury strategies involving complex financial instruments such as convertible bonds, perpetual equity, and synthetic ATM offerings to accumulate Bitcoin. These actions are reframing Bitcoin not only as a treasury asset but also as a disruptive force within traditional finance. Public companies’ embrace of Bitcoin is now viewed as a “Trojan Horse” strategy that integrates crypto deeper into the system. Meanwhile, governments are taking steps toward adoption through crypto-based payment systems and proposed strategic reserves. High-net-worth individuals and institutional investors are also warming to Bitcoin, although adoption is tempered by legacy biases and a lack of understanding. Framing Bitcoin in terms of Satoshis is seen as a way to make the asset more psychologically accessible.

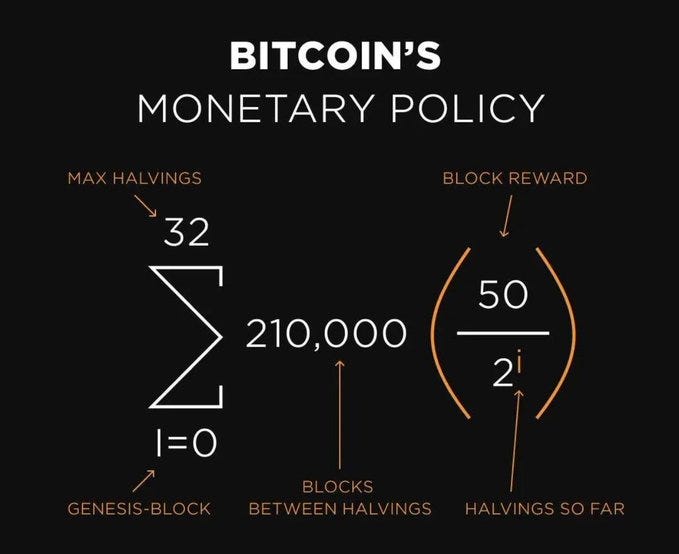

Amid adoption trends, broader macroeconomic conditions and philosophical shifts underpin Bitcoin’s growing role. The deteriorating U.S. fiscal situation, declining global demand for Treasuries, and an unsustainable debt-to-GDP ratio are challenging the safe-haven status of U.S. bonds. Thought leaders like Jeff Booth argue that inflation is not natural but the result of fiat manipulation, whereas Bitcoin represents a deflationary alternative aligned with productivity and innovation. Bitcoin is increasingly seen as a decentralized counter-system—a peaceful, censorship-resistant form of economic sovereignty that challenges central control. Developers stress the importance of node operation and self-custody to preserve decentralization. Regulatory clarity is slowly emerging, with new bills supporting crypto use in payments and stablecoin structures. As demand rises and supply remains capped, 2025 is expected to see heightened volatility, greater institutional friction, and deeper philosophical debates about Bitcoin’s role as both a financial asset and a societal reset mechanism.

Is a Bitcoin price rally to $150K possible by year's end?

https://cointelegraph.com/news/is-bitcoin-price-rally-to-150k-possible-by-year-end

Fidelity: An overview of Bitcoin and its potential use cases.

https://fwc.widen.net/s/kz8ddvftg5/fda-bitcoin-coin-report---12-06

Fidelity: Adding Bitcoin to a Corporate Treasury

https://www.fidelitydigitalassets.com/research-and-insights/adding-bitcoin-corporate-treasury?ccsource=owned_social_btc_corp_treasury_june_x

Fidelity: 2025 crypto midyear outlook.

https://www.fidelity.com/learning-center/trading-investing/crypto-midyear-outlook-2025

Bitcoin Golden Cross Pattern Says The Crash To $100,000 Is Normal – What To Expect Next.

https://www.tradingview.com/news/newsbtc:33d61434c094b:0-bitcoin-golden-cross-pattern-says-the-crash-to-100-000-is-normal-what-to-expect-next/

Trump social-media company seeks bitcoin ETF in latest move into crypto, partnering with a company that could invite conflicts of interest.

https://www.marketwatch.com/story/trump-media-seeks-bitcoin-etf-in-latest-move-into-crypto-3f859bfb

Strategy Announces Pricing of Initial Public Offering of STRD Stock.

https://www.strategy.com/press/strategy-announces-pricing-of-initial-public-offering-of-strd-stock_06-08-2025

California Passes Bill To Accept Crypto For State Payments.

https://www.zerohedge.com/crypto/california-passes-bill-accept-crypto-state-payments

Strategy Acquires 705 BTC and Now Holds 580,955 BTC.

https://www.strategy.com/press/strategy-acquires-705-btc-and-now-holds-580-955-btc_06-02-2025

How Strategy (MSTR) Built Their Capital Stack to Accelerate Bitcoin Accumulation.

https://bitcoinmagazine.com/bitcoin-for-corporations/how-strategy-mstr-built-their-capital-stack-to-accelerate-bitcoin-accumulation#google_vignette

Bitcoin Core development and transaction relay policy.

https://bitcoincore.org/en/2025/06/06/relay-statement/