Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and ChatGPT to summarize the information in this week’s news links:

Bitcoin is grounded in the principles of decentralization, transparency, and economic discipline. Its protocol operates on a global network of nodes that independently verify transactions, creating a secure and resilient system that resists centralized control or manipulation. This distributed structure not only provides redundancy and censorship resistance but also underpins Bitcoin's ideological stance as a "truth machine." With a capped supply of 21 million coins and energy-bound validation, Bitcoin embodies deflationary economics, positioning itself as a fundamentally different alternative to inflation-prone fiat currencies. The journey from price speculation to self-custody reflects a broader movement toward individual financial sovereignty, with users gaining autonomy by running their own nodes and verifying transactions independently.

On a global scale, Bitcoin is increasingly viewed as a hedge against fiat debasement and as a superior form of collateral. Institutional players like MicroStrategy have adopted it as part of their corporate treasury strategy, leveraging low borrowing costs to accumulate substantial holdings. Governments, too, are showing growing interest—some allocating excess energy to mining and exploring strategic Bitcoin reserves as a means of economic stability. These developments suggest Bitcoin is becoming a permanent fixture in capital markets and international finance. Moreover, Bitcoin’s unique properties have positioned it as a potential alternative to sovereign debt, appealing to entities seeking stable, non-inflationary stores of value amid a backdrop of monetary instability.

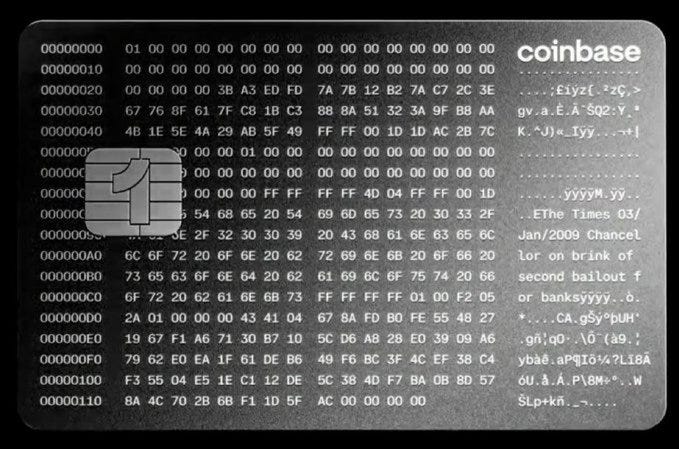

However, challenges remain. The growing centralization of custody—particularly among institutions like Coinbase—threatens Bitcoin’s decentralized ethos, echoing past mistakes made with gold. Debate continues around whether Bitcoin is entering a long-term “supercycle” or remains subject to boom-bust volatility, especially in a complex macroeconomic environment. Regulatory pushback and political resistance from traditional institutions like the IMF also present barriers to broader adoption. Furthermore, a persistent narrative gap hinders mainstream understanding—many still dismiss Bitcoin as a scam or feel excluded due to past price rises. Bridging this gap will require continued education and cultural shifts as more people come to appreciate Bitcoin’s role beyond price speculation.

Where Could Bitcoin Peak This Cycle?

https://bitcoinmagazine.com/markets/where-could-bitcoin-peak-this-cycle

How bitcoin price’s newest source of long-term support is evolving.

https://www.cnbc.com/2025/06/12/how-bitcoin-prices-newest-source-of-long-term-support-is-evolving.html

Bitcoin price targets mushroom as traders bet on $140K+ this bull run.

https://cointelegraph.com/news/bitcoin-price-targets-mushroom-traders-bet-on-200k-this-bull-run

Billionaire Mike Novogratz Details Massive Bitcoin Price Target, Says BTC Adoption As Macro Asset Approaching Maximum Speed.

https://dailyhodl.com/2025/06/14/billionaire-mike-novogratz-details-massive-bitcoin-price-target-says-btc-adoption-as-macro-asset-approaching-maximum-speed/

Bitcoin price breakout to $119K possible if oil rally pattern holds.

https://cointelegraph.com/news/bitcoin-price-rebound-oil-rally-setup-119k-target

Bitcoin mirrors 80% rally setup that preceded 2024 Israel-Iran conflict.

https://cointelegraph.com/news/bitcoin-mirrors-80-rally-setup-that-preceded-2024-israel-iran-conflict

Trump Media's registration for bitcoin treasury deal becomes effective.

https://www.reuters.com/world/us/trump-medias-registration-bitcoin-treasury-deal-becomes-effective-2025-06-13/

Coinbase CEO Brian Armstrong: Ballooning government debt may make bitcoin the world's reserve currency.

https://finance.yahoo.com/news/coinbase-ceo-brian-armstrong-ballooning-government-debt-may-make-bitcoin-the-worlds-reserve-currency-090043817.html

Coinbase Issues $130 Billion ‘Systemic’ Bitcoin Price Warning.

https://www.forbes.com/sites/digital-assets/2025/06/13/coinbase-issues-130-billion-systemic-bitcoin-price-warning/

Crypto’s hottest new trend: publicly traded companies buying bunches of bitcoin.

https://apnews.com/article/bitcoin-treasury-companies-donald-trump-michael-saylor-2a767b92cd1cd83038bdd675c4ef26d6

GameStop Joins $50 Billion Institutional Surge Into Bitcoin as Treasury Asset.

https://www.pymnts.com/cryptocurrency/2025/strategy-gamestop-lead-50-billion-institutional-surge-into-bitcoin-as-treasury-asset/

Pakistan’s Strategic Bitcoin Reserve: A Step Toward Orange-Pilling a Nation.

https://bitcoinmagazine.com/politics/pakistans-strategic-bitcoin-reserve-a-step-toward-orange-pilling-a-nation

There’s a Good Chance Crypto Is Spreading in Your Retirement Account.

https://www.nytimes.com/2025/06/13/business/bitcoin-cryptocurrency-stablecoins-retirement.html