Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and ChatGPT to summarize the information in this week’s news links:

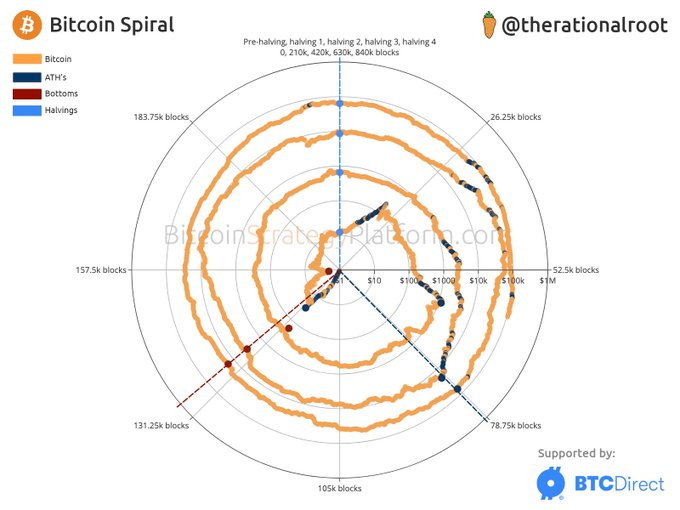

The traditional 4-year cycle that has historically governed Bitcoin’s price behavior—largely linked to its halving events—is increasingly being reshaped by global macroeconomic forces and institutional involvement. Rather than being driven primarily by retail speculation, Bitcoin is now more sensitive to global liquidity trends and monetary policy, with analysts like Jack Mallers calling it a real-time index of global money printing. While this institutional participation may temper the dramatic boom-bust volatility of past cycles, it also contributes to more sustained upward momentum. On-chain metrics suggest that the current bull run is far from exhausted, indicating the possibility of continued growth. Nevertheless, market psychology remains a powerful force, ensuring that bull and bear phases—albeit less extreme—are likely to persist.

At the same time, a new breed of Bitcoin treasury companies is emerging, transforming the supply dynamics of the market. Firms like MicroStrategy, MetaPlanet, and Semler Scientific are strategically accumulating Bitcoin, often financed by fiat debt they expect to be inflated away. These companies are not only attracting capital from traditional bond markets with innovative financial products but also creating a reflexive loop where Bitcoin purchases increase shareholder value and attract more capital. With a significant portion of Bitcoin now being held by institutions with long-term horizons, available supply on the open market is shrinking. This dynamic is reinforcing scarcity and potentially driving further price appreciation as demand from ETFs and corporate treasuries outpaces the daily mined supply.

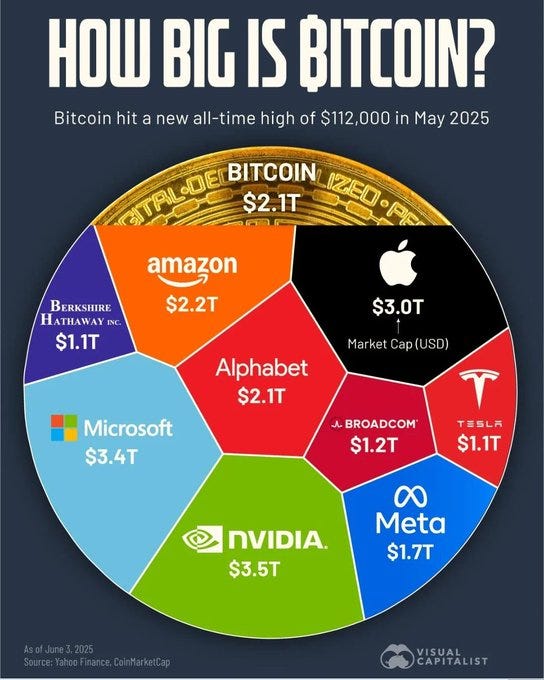

Finally, Bitcoin is increasingly being viewed as a safe haven and an alternative monetary system, even rivaling gold. Amid global de-dollarization, trade tensions, and inflation fears, Bitcoin offers countries, corporations, and individuals a way to diversify away from fiat currency risk. Proponents argue that Bitcoin could even reduce the likelihood of war by limiting governments' ability to fund conflict through unchecked money printing. Institutional capital is further legitimizing Bitcoin, and even state-level reserve policies (like in Texas) signal growing governmental interest. However, challenges remain: volatility, the distant but real threat of quantum computing, and concerns over retail displacement by institutional derivatives. Still, long-term projections remain bullish, with Bitcoin seen as central to a potential multi-trillion—or even quadrillion—dollar monetary future.

Strategy’s Michael Saylor raises Bitcoin forecast to $21M by 2046.

https://cointelegraph.com/news/michael-saylor-strategy-bitcoin-forecast-21-million-21-years

Michael Saylor's Strategy buys another $1.05 billion of bitcoin.

https://finance.yahoo.com/news/michael-saylors-strategy-buys-another-105-billion-of-bitcoin-140056131.html

Who are the companies hoarding bitcoin?

https://www.ft.com/content/394b3a87-bf5e-45dc-8f39-565e89f1fe47

Bitcoin Network Activity Slows While Price Lingers Near Highs.

https://www.bloomberg.com/news/articles/2025-06-20/bitcoin-network-activity-slows-while-price-lingers-near-highs

Spanish bank BBVA tells wealthy clients to invest in bitcoin.

https://www.reuters.com/business/finance/spanish-bank-bbva-tells-wealthy-clients-invest-bitcoin-2025-06-17/

What Happens to Bitcoin When Quantum Computers Arrive?

https://bitcoinmagazine.com/technical/what-happens-to-bitcoin-when-quantum-computers-arrive

Texas governor signs bill adding Bitcoin to official reserves.

https://cointelegraph.com/news/texas-creates-bitcoin-reserve-with-public-funds

Is the 4-Year Bitcoin Cycle Over? Rational Root Explains Why This Time Might Not Be Different.

https://bitcoinmagazine.com/markets/is-4-year-bitcoin-cycle-over-rational-root