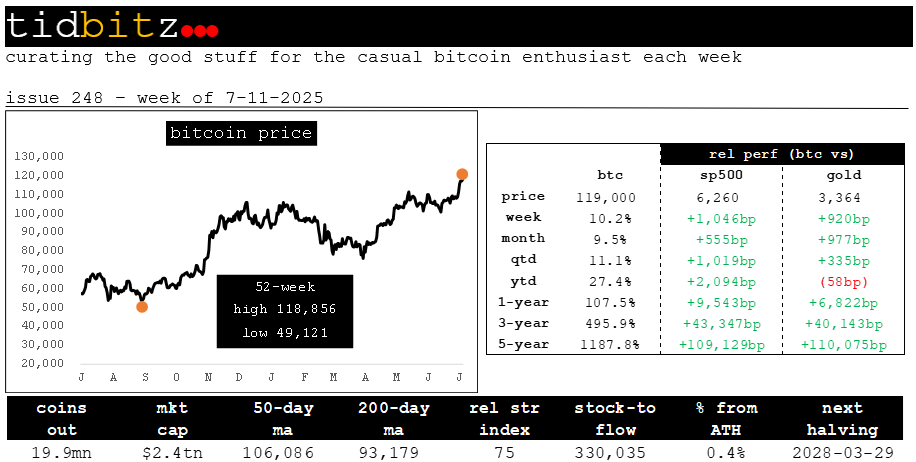

issue 248 - week of 7-11-25

curating the good stuff for the casual bitcoin enthusiast each week

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

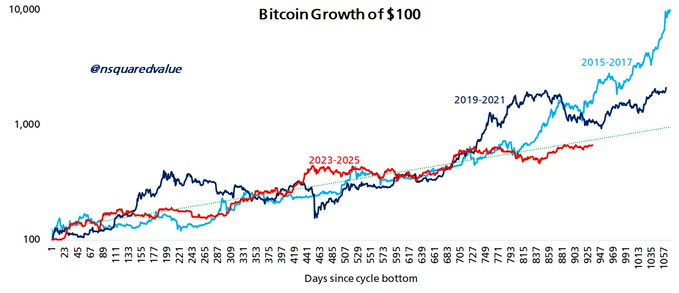

📈 Bitcoin is currently in a significant bull run, with its price recently surpassing $118,000, driven by substantial inflows into spot Bitcoin ETFs and a crypto-friendly regulatory environment. Analysts like Jeff Ross project Bitcoin to reach $475,000 by late 2025 or early 2026, while Ric Edelman forecasts $500,000 by the decade's end. This surge is further fueled by a growing trend of publicly traded companies adding Bitcoin to their treasuries, indicating a fundamental shift in corporate asset management.

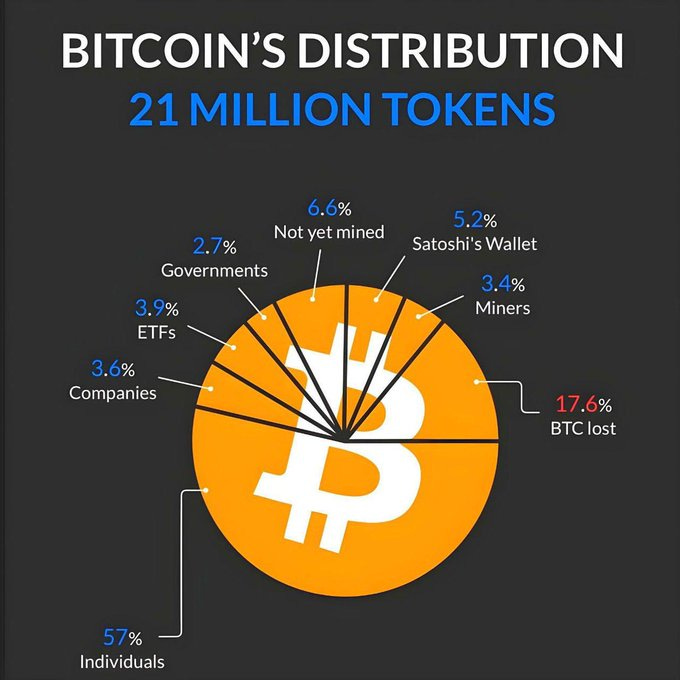

⚙️ The increasing adoption of Bitcoin is propelled by several interconnected factors, including the accessibility offered by spot Bitcoin ETFs and a more positive regulatory stance from the U.S. government. Beyond institutional and corporate interest, Bitcoin's core principles of self-custody and decentralization remain crucial, with experts emphasizing the importance of running a node to maintain network integrity. While debates within the community, such as the Bitcoin Core versus Knots discussion over transaction policy rules, highlight internal disagreements, these discussions ultimately contribute to Bitcoin's robust and unchangeable nature, ensuring its long-term resilience.

🚀 The Bitcoin ecosystem is also expanding through new technologies and financial instruments. Innovations like Nostr are building decentralized identity and communication layers, while Bitcoin Solaris aims to offer a high-speed, energy-efficient blockchain for mobile users. The Lightning Network continues to be vital for scaling Bitcoin payments, demonstrating its potential for generating yield and facilitating instant settlements. Ultimately, Bitcoin is viewed as more than just an asset; it's seen as a "freedom technology" capable of building generational wealth, fostering societal paradigm shifts, and empowering individuals globally.

Bitcoin Hits New Highs: 6 Reasons Why the ETF Rally Could Continue

Summary: Bitcoin soared to a new all-time high of over $117,000, driven by bullish momentum in risk assets, record inflows into Bitcoin ETFs, expanding corporate and institutional adoption (including by companies like GameStop and Goldman Sachs), its role as an inflation hedge, favorable policy signals, and Bitcoin miners leveraging their infrastructure for AI.

Link: https://www.nasdaq.com/articles/bitcoin-hits-new-highs-6-reasons-why-etf-rally-could-continue

Bitcoin Tops $118,000 in Another All-Time High

Summary: Bitcoin surpassed the $118,000 mark for the first time, continuing its ascent fueled by increasing corporate adoption as a reserve asset and the passage of pro-crypto legislation, particularly the GENIUS Act concerning stablecoins. This rise significantly outpaces the S&P 500's gains this year.

Link: https://www.investopedia.com/bitcoin-soars-to-a-new-record-high-11770332

Bitcoin Price Prediction 2025, 2026- 2030: BTC Breakout Above $118K Signals New Bull Cycle

Summary: Bitcoin's price prediction turns highly bullish after BTC reached a new all-time high of $118K, driven by strategic geopolitical moves, record $1.18 billion ETF inflows, and a U.S. Strategic Bitcoin Reserve. Analysts foresee potential surges to $130K-$150K by Q4 2025, with a long-term bullish outlook extending to 2030, supported by increasing adoption and institutional interest.

Link: https://coindcx.com/blog/price-predictions/bitcoin-price-weekly/

Bitcoin’s Path to a New All-Time High, in Charts

Summary: The Wall Street Journal article "Bitcoin’s Path to a New All-Time High, in Charts" explores Bitcoin's price surge toward a potential new peak, likely highlighting key market trends and drivers through visual data. As of July 12, 2025, Bitcoin is nearing or surpassing its previous high of around $103,332 from late 2021, fueled by strong institutional adoption, such as Bitcoin ETF inflows, positive market sentiment, and macroeconomic factors like anticipated interest rate cuts and Bitcoin’s appeal as an inflation hedge. The article likely includes charts showing price trends, trading volumes, and technical indicators like resistance breakouts, alongside on-chain metrics reflecting network activity. While the full article is paywalled, posts on X and web sources emphasize bullish momentum, with the 2024 halving further supporting reduced supply growth as a catalyst for price increases.

Link: https://www.wsj.com/finance/currencies/bitcoins-path-to-a-new-all-time-high-in-charts-b10370f1

MicroStrategy Stock Pops as Bitcoin Hits Record. Its Crypto Holding Is Now Worth This.

Summary: The Barron’s article discusses the performance of crypto-related stocks, focusing on MicroStrategy and Coinbase, amid Bitcoin's surge past $100,000 in 2024. MicroStrategy, now rebranded as Strategy, has become a significant Bitcoin holder, owning 581,000 bitcoins valued at approximately $63 billion, funded through debt and equity raises. Its stock has risen over 500% in 2024, driven by Bitcoin’s rally, but its market value is 2.5 times its Bitcoin holdings, suggesting a premium that could lead to volatility if Bitcoin prices fall. Coinbase, a leading crypto exchange, has also benefited from the crypto boom, with its stock up significantly due to increased trading and ETF custody roles, though it faces regulatory risks. Both companies are seen as proxies for Bitcoin investment, but their high valuations raise concerns about potential corrections if the crypto market cools.

Link: https://www.barrons.com/articles/microstrategy-stock-coinbase-bitcoin-crypto-7dc05c6e

The Smarter Web Company Adds 275 BTC to Its Strategic Bitcoin Treasury

Summary: The UK tech firm, The Smarter Web Company, announced an additional purchase of 275 BTC, bringing its total Bitcoin holdings to 1,275 BTC, valued at over £100 million. This move further highlights the increasing trend of corporate balance sheet allocation to Bitcoin.

Link: https://bitcoinmagazine.com/markets/5-free-metrics-bitcoin-investor

Bitcoin Breaks Records with 100% Profitable Days and Unmatched Returns

Summary: Bitcoin continues its explosive growth, demonstrating 100% profitable trading days and consistently outperforming traditional assets like gold, stocks, and the dollar, solidifying its position as a strong long-term investment with unmatched returns.

Link: https://bitcoinmagazine.com/markets/5-free-metrics-bitcoin-investor

Bitcoin Hits New All Time High as IBIT Breaks ETF Records

Summary: Bitcoin reached a new all-time high, coinciding with BlackRock's Bitcoin ETF (IBIT) breaking new records for inflows. This indicates robust institutional demand and confirms the significant impact of spot ETFs on Bitcoin's market performance.

Link: https://bitcoinmagazine.com/markets/5-free-metrics-bitcoin-investor

How CoinJoin Anonymity Can Be Undermined Using Clustering

Summary: This article delves into the technical aspects of Bitcoin privacy, specifically addressing how CoinJoin, a key anonymity feature, can have its effectiveness reduced through clustering techniques, potentially exposing more information than users intend.

Link: https://bitcoinmagazine.com/markets/5-free-metrics-bitcoin-investor

Metaplanet Beats Bhutan in Bitcoin Race with $400M Lead in Holdings