Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

💰 Bitcoin has evolved from a speculative digital currency to a cornerstone of the global financial system, increasingly viewed as "digital gold" due to its provably scarce nature and institutional adoption. On-chain velocity is at historic lows, with over 70% of Bitcoin unmoved for over a year, reflecting a shift toward long-term holding, particularly by institutions like MicroStrategy and Tesla, which treat it as a strategic reserve. The 2024 launch of US spot Bitcoin ETFs has driven institutional holdings to approximately 12.8% of circulating supply, locking up coins in cold storage and reinforcing Bitcoin’s scarcity-driven value proposition. Meanwhile, off-chain activity thrives through Layer-2 solutions like the Lightning Network, with a 400% capacity increase since 2020, and Wrapped Bitcoin, which grew 34% in 2025, fueling decentralized finance (DeFi) and payment systems.

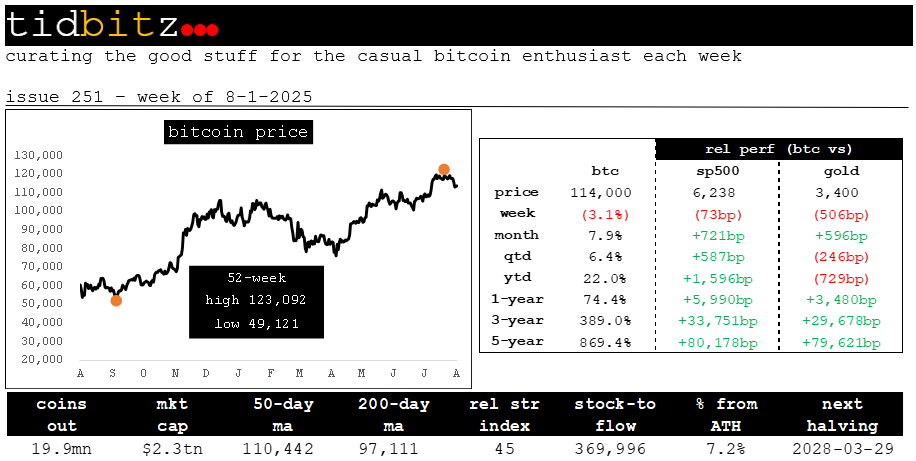

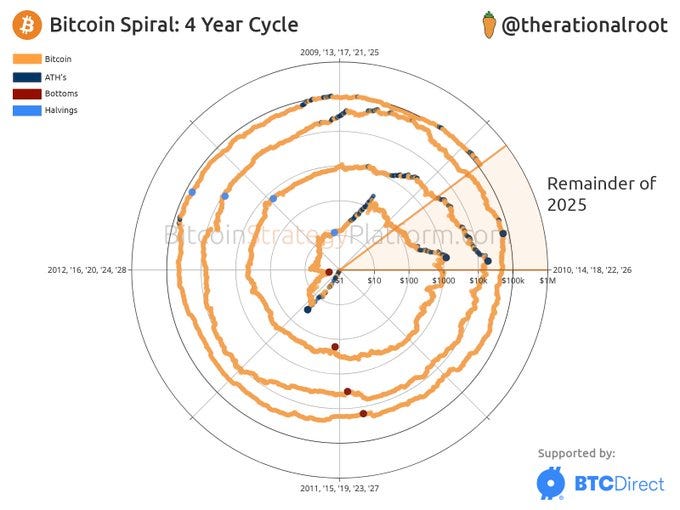

🔒 Bitcoin’s design prioritizes security and decentralization over scalability, as outlined in the blockchain trilemma, making it the most secure digital asset with a hash rate that deters 51% attacks. Its fixed 21-million-coin supply and halving events, like the one in April 2024, historically drive price surges, with analysts predicting a cycle peak of $130,000–$200,000 by October 2025. However, scalability remains a challenge, with Bitcoin processing only 3–7 transactions per second compared to Visa’s 9,000, pushing innovation to off-chain solutions. The macroeconomic environment, characterized by currency debasement and geopolitical tensions, bolsters Bitcoin’s appeal as a hedge against inflation, with countries like China and Russia exploring neutral reserve assets, and the US embracing Bitcoin through a strategic reserve initiative under President Trump.

🏢 Corporate adoption is accelerating, with companies like MicroStrategy holding 628,791 BTC and introducing innovative financial products like "Stretch," a Bitcoin-backed perpetual stablecoin offering 9% yield. New metrics like “Bitcoin per share” reflect a shift toward valuing wealth in Bitcoin terms amid fiat debasement concerns. Regulatory landscapes are evolving, with the US moving from a hostile stance to bipartisan support, exemplified by the Genius Act for stablecoins and proposed Clarity Act. Despite risks like regulatory hurdles and potential code vulnerabilities, Bitcoin’s resilience, liquidity, and growing integration into e-commerce (e.g., via Coinbase’s partnership with Shopify) signal its potential to reshape finance, prioritizing economic freedom and property rights in an increasingly uncertain global economy.

STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY

Summary: This report, "Strengthening American Leadership in Digital Financial Technology," outlines the Trump Administration's strategy to foster responsible growth in digital assets and blockchain technology, aiming for U.S. global leadership. It proposes policies to protect individual digital asset ownership, clarify market regulation for deeper liquidity, encourage bank engagement without restrictive practices, promote U.S. dollar-backed stablecoins while prohibiting central bank digital currencies (CBDCs), enhance tools to combat illicit finance, and modernize digital asset taxation. The core objective is to position the U.S. as the "crypto capital of the world" by embracing innovation and establishing clear regulatory frameworks.

Link: https://www.whitehouse.gov/crypto/

Fidelity Digitial Assets: Bitcoin (BTC) - An overview of Bitcoin and its potential use cases.

Summary: The blockchain trilemma states Bitcoin prioritizes decentralization and security over scalability, leading to strong resistance against attacks but slower transaction speeds. The report positions Bitcoin as a macroeconomic hedge and a competitor to gold, driven by its scarcity from halving events and network effects. It concludes by outlining future scenarios for Bitcoin and potential risks like technical vulnerabilities and regulatory issues.

Link: https://fwc.widen.net/s/kz8ddvftg5/fda-bitcoin-coin-report---12-06

Are Miners Front-Running the Next Bitcoin Price Rally?

Summary: This article explores the possibility of Bitcoin miners "front-running" the next price rally, citing several indicators. It highlights a rare "buy" signal from hash ribbons, which historically precedes significant Bitcoin price increases, emerging after a period of miner capitulation due to factors like rising electricity costs. The article also notes a rebound in Bitcoin miner profitability, as indicated by The Puell Multiple, and points out that Bitcoin mining stocks are outperforming Bitcoin, suggesting investor confidence. These combined factors – the hash ribbons buy signal, improving profitability, and sustained hashrate growth – indicate a renewed bullish outlook among miners for the Bitcoin market.

Link: https://bitcoinmagazine.com/markets/bitcoin-miners-front-running-next-rally

Strategy Acquires 21,021 BTC and Now Holds 628,791 BTC

Summary: This article reports that Strategy recently acquired an additional 21,021 BTC, increasing its total Bitcoin holdings to 628,791 BTC. This acquisition was announced in a Form 8-K filing on July 29, 2025. The article also includes details about the company's website cookie policy, explaining their use for site navigation, performance analysis, and marketing, and offering users options to manage their cookie preferences.

Link: https://www.strategy.com/press/strategy-acquires-21021-btc-and-now-holds-628791-btc_07-29-2025

Bitcoin “tick tock” fractal predicts $150K BTC price top in October.

Summary: This article from Cointelegraph, published on July 31, 2025, suggests that Bitcoin could reach a bull cycle top of $150,000 by October, based on historical halving-cycle fractals. Analyst CryptoBullet's "tick-tock" fractal predicts Bitcoin peaks around 518-546 days after each halving, aligning the next potential top with October 2025. On-chain data, including increasing new investor activity and strong absorption from institutions and ETFs, supports this bullish outlook, indicating the market has room for further growth before becoming overheated.

Link: https://cointelegraph.com/news/bitcoin-tick-tock-fractal-predicts-150k-btc-price-top-october

What Bitcoin's Velocity Says About Its Future.