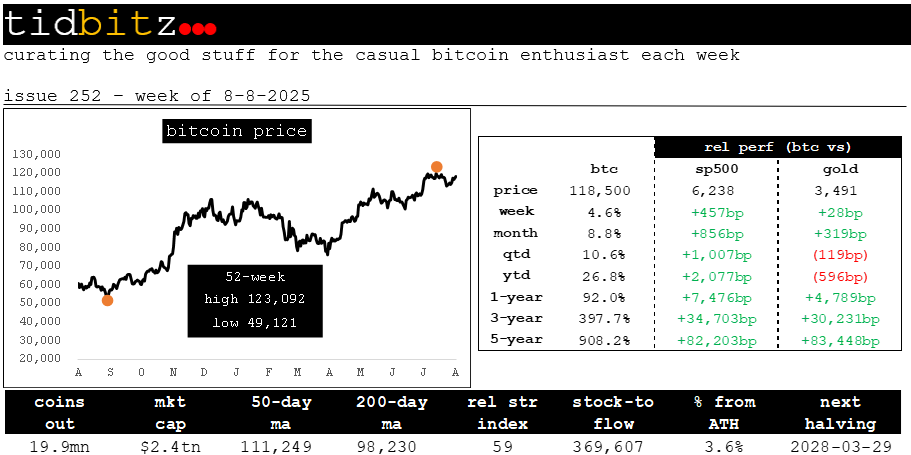

issue 252 - week of 8-8-25

curating the good stuff for the casual bitcoin enthusiast each week

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

🚀 Bitcoin's transformation from a niche digital asset to a mainstream financial instrument is driven by regulatory advancements, institutional adoption, and its appeal as "hard money." The critique of fiat currency, exemplified by the 2007-2008 financial crisis and rising global debt ($250 trillion against an $80 trillion economy), underscores Bitcoin's allure as a deflationary alternative. Influential works like The Bitcoin Standard and The Price of Tomorrow highlight its role in challenging inflationary systems, with the post-1971 fiat experiment seen as unsustainable. Regulatory shifts, such as the U.S. allowing Bitcoin in 401(k)s and establishing a Strategic Bitcoin Reserve, alongside El Salvador's legal tender adoption, signal a new monetary era where Bitcoin is increasingly viewed as a strategic asset.

🏦 Institutional demand is reshaping Bitcoin's market dynamics, with companies like MicroStrategy and Tesla holding significant Bitcoin treasuries, treating it as a store of value. The inclusion of Bitcoin in retirement accounts and pension funds, potentially unlocking trillions, is expected to drive consistent demand and price appreciation, with projections ranging from $1 million by 2028 to $5 million by 2031 in aggressive scenarios. However, Bitcoin's fixed 21 million coin supply and increasing "HODLing" (45% dormant for over three years) could trigger a supply shock, amplifying volatility. This institutionalization, dubbed the "institutionalization of rebellion," sees traditional financial giants like JPMorgan and Goldman Sachs embracing blockchain technologies, integrating Bitcoin into legacy systems.

⚠️ Despite its momentum, Bitcoin's adoption faces challenges, including volatility, regulatory hesitancy, and an education gap, with only 5% of Americans aware of its supply cap. Critics like Peter Schiff warn of its speculative risks in retirement portfolios, while advisors hesitate to be "first movers" due to regulatory concerns. Custody solutions like ETFs are critical for mass adoption, as self-custody remains impractical for most. Bitcoin's broader implications include financial inclusion for those in unstable economies, potential job displacement from automation, and a philosophical shift toward decentralization and truth without intermediaries. Balancing these ideals with institutional integration will determine Bitcoin's long-term impact on global finance.

Bitcoin jumps as Trump is set to sign an order that allows cryptocurrencies in 401(k)s

Summary: On August 7, 2025, Bitcoin and other cryptocurrency prices jumped in anticipation of President Trump signing an executive order that would allow 401(k) accounts to invest in crypto and other alternative assets. The CNBC article, as referenced in search results, noted that the inclusion of Bitcoin in the retirement market, valued at $43 trillion, has been seen as a "holy grail" for the crypto industry. This move is considered the latest in a series of efforts by the Trump administration to make the U.S. the "crypto capital of the world." The price of Bitcoin climbed to reclaim the $116,000 level, and crypto-linked stocks also saw a boost.

Link: https://www.cnbc.com/2025/08/07/bitcoin-jumps-as-trump-is-set-to-sign-an-order-that-allows-cryptocurrencies-in-401ks.html

Bitcoin likely to lead gains from Trump’s 401(k) crypto order

Summary: A new executive order from President Trump allows cryptocurrencies and other alternative assets in 401(k) and other defined-contribution retirement accounts. The crypto industry, including leaders from Bitwise and the Crypto Council for Innovation, largely sees this as a positive and transformative step for the markets. They believe it will introduce a steady flow of capital into crypto and affirm the place of digital assets in the financial system. However, some critics, such as gold advocate Peter Schiff, fear that this could worsen the retirement savings gap by encouraging people to "gamble" their savings. Others, like Tezos co-founder Arthur Breitman, support the choice but caution against potential issues like high fees and poor allocation decisions by inexperienced investors.

Link: https://cointelegraph.com/news/trump-executive-order-crypto-401k-industry-reactions

Trump wants your 401(k) to access crypto and private equity. Here's what to know.

Summary: The CBS News article discusses a new executive order signed by President Trump that allows 401(k) retirement plans to invest in alternative investments like private equity and cryptocurrencies. The order aims to "democratize retirement" and offer workers more investment choices. While these investments have the potential for higher returns, they also carry significant risks, such as a lack of transparency in private equity and the high volatility of cryptocurrencies. The article also notes that alternative investments often have higher fees, and it may take several years for the changes to be fully implemented.

Link: https://www.cbsnews.com/news/trump-401k-changes-executive-order-risk-what-to-know/

Harvard’s Endowment Goes Big on Bitcoin and Gold in Second Quarter of 2025

Summary: The Harvard Management Company's (HMC) investment strategy for the second quarter of 2025 included significant new investments in both Bitcoin and gold. HMC purchased $116.7 million worth of iShares Bitcoin Trust and $101.5 million worth of SPDR Gold Trust. This move is a shift for the endowment, which had previously exited many of its Big Tech holdings. Experts cited inflation fears as a reason for this turn to "stores of value," though some also view Bitcoin as "extremely speculative" for a university endowment. The total value of HMC's public equity portfolio grew to $1.43 billion in the second quarter.

Link: https://www.thecrimson.com/article/2025/8/9/hmc-q2-2025-filings/

A Supply and Demand Framework for Bitcoin Price Forecasting

Summary: The article presents a new supply and demand framework for forecasting the price of Bitcoin, developed by Murray A. Rudd and Dennis Porter. The model uses the April 2024 halving as a baseline and suggests that institutional and sovereign accumulation of Bitcoin could significantly influence price trajectories. The study's forecasts suggest that a 10x increase in demand could see Bitcoin's price surpass $600,000, even without withdrawals from the liquid supply. The authors conclude that the framework is a flexible tool for investors and policymakers to understand how supply-demand dynamics influence Bitcoin's potential as a strategic asset.

Link: https://www.mdpi.com/1911-8074/18/2/66

Bitcoin Treasuries and the Transformation of Investment Strategy

Summary: The article "Bitcoin Treasuries and the Transformation of Investment Strategy" discusses the significant shift of Bitcoin from a retail investment trend to a key component of institutional and corporate financial strategies. Companies like MicroStrategy and Robinhood are leading this trend, amassing large holdings and treating Bitcoin as a long-term store of value. This institutional engagement impacts market liquidity and volatility, while also challenging the traditional decentralization ethos of crypto. The article concludes that the rise of Bitcoin treasuries is a pivotal moment that will reshape investment paradigms for years to come.

Link: https://www.onesafe.io/blog/bitcoin-treasuries-investment-strategy

3 Reasons to Buy Bitcoin Before 2026

Summary: The article discusses why Bitcoin is becoming more attractive to investors. The first reason is improving regulatory clarity, with the Trump administration's efforts to clarify crypto rules giving investors more confidence. Second, this clarity strengthens Bitcoin's case as a legitimate long-term "digital gold" due to its fixed supply, making it attractive during times of inflation. Finally, clearer rules are inspiring institutional investors, such as pension funds and insurance companies, to allocate capital to Bitcoin, which boosts market stability and signals growing mainstream acceptance.

Link: https://www.fool.com/investing/2025/08/09/3-reasons-to-buy-bitcoin-before-2026/

Bitcoin investment banks coming to El Salvador — Gov regulator

Summary: The article discusses a new Investment Banking Law in El Salvador, which allows for the creation of regulated Bitcoin investment banks. These banks are permitted to hold Bitcoin and other digital assets on their balance sheets and offer crypto services to "sophisticated" investors. This legislation is intended to attract foreign investment and establish El Salvador as a financial hub. While supporters view this as a positive development, critics argue that the country's pro-crypto policies benefit the government and large businesses more than the average citizen. The article also highlights El Salvador's international efforts to promote crypto, including discussions with Pakistan and an agreement with Bolivia's central bank.

Link: https://cointelegraph.com/news/bitcoin-investment-banks-coming-el-salvador

How Preston Pysh Changed My Mind on Bitcoin Treasuries