issue 253 - week of 8-15-25

curating the good stuff for the casual bitcoin enthusiast each week

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

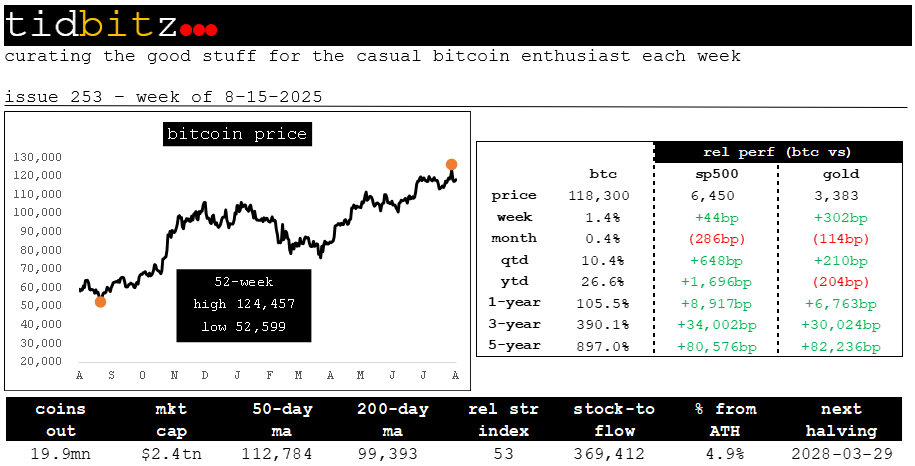

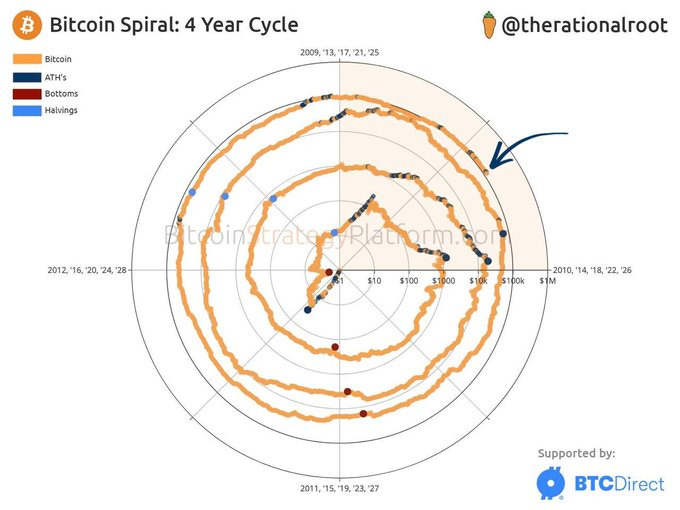

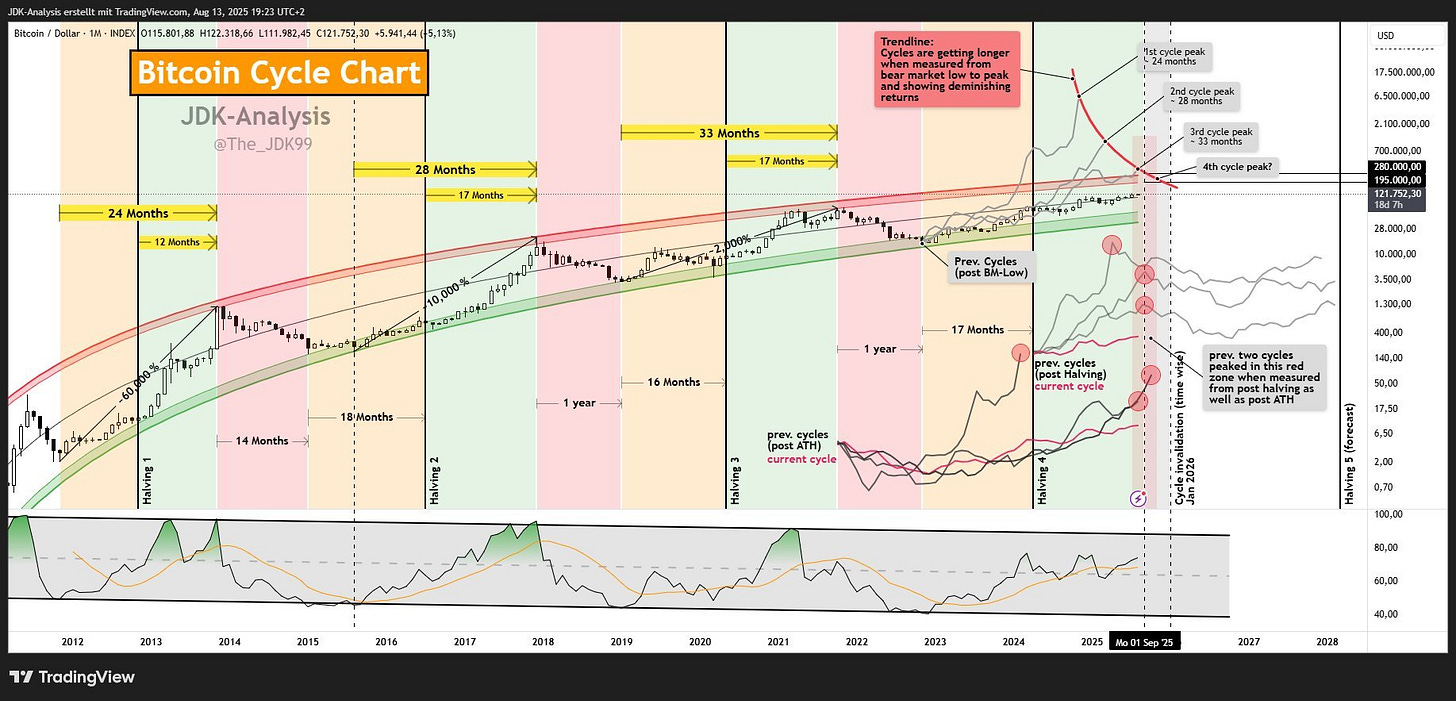

✨ The Bitcoin market is experiencing a robust bull run, with prices soaring past $124,000 in August 2025, driven by a combination of post-halving supply constraints, growing institutional adoption, clearer regulations, and widespread investor acceptance. Projections suggest Bitcoin could reach $150,000 by year-end, with some optimistic forecasts eyeing $200,000 by December 2025 and even $1 million by 2030. However, diminishing returns are evident, with price increases dropping from 60,000% in the first cycle to 2,000% in the third, while cycle lengths are extending, potentially peaking around late 2025 or early 2026. The rise of "Bitcoin Treasury Companies" (BTCs) like Bitcoin Standard Treasury Co. is revolutionizing capital flows, channeling traditional finance into Bitcoin through innovative share issuance and acquisitions, positioning these firms as key players in global markets.

📈 Several tailwinds are fueling this growth. The April 2024 halving reduced Bitcoin's new supply, amplifying scarcity as demand surges from corporations, financial institutions, and even governments, with over 14% of Bitcoin’s 21 million cap held by ETFs, public companies, and countries. Regulatory clarity, such as the SEC’s approval of spot Bitcoin ETPs and the E.U.’s MiCA framework, has bolstered institutional confidence, while U.S. policies, including a Strategic Bitcoin Reserve and Bitcoin’s inclusion in 401(k)s, signal strong governmental support. Bitcoin is increasingly seen as a superior asset, challenging traditional bonds and the 60/40 portfolio model, with BTCs and platforms like Bitcoin-backed lending bridging Wall Street and the crypto ecosystem, offering liquidity and yield without selling assets.

🔒 Despite this optimism, challenges persist, including government overreach, privacy concerns, and Bitcoin’s inherent volatility, though proponents view the latter as a positive trait of an appreciating asset. Bitcoin’s security and decentralization remain robust, with market-driven fees and difficulty adjustments ensuring network resilience. Bitcoin Treasury Companies are decentralizing ownership by making Bitcoin accessible through traditional investment vehicles, countering centralization fears. The narrative of Bitcoin as "freedom money" endures, supported by privacy-enhancing tools, with proponents believing unstoppable fiscal deficits and currency debasement will drive hyperbitcoinization—potentially achieving global adoption within our lifetime, positioning Bitcoin as the cornerstone of a new monetary era.

Bitcoin Soars Past $124k, a New All-Time High. 4 Tailwinds Behind the Momentum.

Summary: This article discusses the recent surge in Bitcoin's price. The article highlights four key factors or "tailwinds" driving this momentum. The first is the post-halving scarcity, which has reduced the supply of new bitcoins entering the market. The second factor is the increasing accumulation by long-term holders such as corporations and financial institutions. The third tailwind is improved regulatory clarity, with the U.S. SEC approving spot Bitcoin ETFs. Finally, the article notes that Bitcoin is now widely accepted across the investor spectrum, from retail investors to large institutions, ensuring continuous demand.

Link: https://www.fool.com/investing/2025/08/16/bitcoin-soars-past-123k-a-new-all-time-high-4-tail/

Bitcoin has “greater than 50% chance” of $150K before bear hits: Exec.

Summary: According to an article from Cointelegraph, a crypto executive from Canary Capital believes there is a greater than 50% chance that Bitcoin will reach a price of $140,000 to $150,000 this year. He predicts that this surge, driven by institutional inflows from Bitcoin ETFs and treasury firms, will be followed by a bear market in 2026. This forecast is based on his concerns about the current macroeconomic outlook. The article also notes that not all experts agree, with figures like Michael Saylor and Matt Hougan predicting that the bull market will continue for the foreseeable future.

Link: https://cointelegraph.com/news/bitcoin-price-forecast-2025-bear-market-dooms-crypto-executive

Ivy League Schools Betting Big On Bitcoin? Harvard Reveals Nearly $117M Bitcoin ETF Position, Brown Doubles Holdings

Summary: According to multiple sources, Harvard University's endowment has disclosed a significant investment in BlackRock's iShares Bitcoin Trust (IBIT) ETF. The university's holding of over $116 million in the Bitcoin ETF reportedly surpasses its stakes in major tech companies like Google and Nvidia. Another Ivy League school, Brown University, has also increased its Bitcoin ETF holdings to over $13 million. These investments, along with others by institutions, are being seen as a sign of growing institutional adoption of cryptocurrencies. The move indicates a shift among traditional, conservative asset managers toward regulated digital asset products.

Link: https://finance.yahoo.com/news/ivy-league-schools-betting-big-163102258.html

Crypto group backed by Trump sons hunts for bitcoin companies in Asia.

Summary: A cryptocurrency company, American Bitcoin, founded by Donald Trump Jr. and Eric Trump, is reportedly looking to acquire companies in Asia, according to a Financial Times report. The company's goal is to expand its Bitcoin holdings and create a Bitcoin accumulation platform similar to the model used by Michael Saylor's MicroStrategy. The firm has raised $200 million to accelerate its mining operations and treasury growth, and is currently evaluating opportunities in Japan and Hong Kong. American Bitcoin went public through a merger with Nasdaq-listed Gryphon Digital Mining. While no binding deals have been made, this move signals a clear intent to expand its global footprint.

Link: https://www.ft.com/content/61abe931-390c-499a-951f-d0e95672fb0b

How Jack Dorsey’s Block Inc Is Reinventing Finance With Bitcoin.

Summary: Jack Dorsey's company, Block Inc. (formerly Square), is aiming to reinvent the financial system by making Bitcoin a central part of its various services. The company's Cash App has become a significant source of Bitcoin revenue and is working to integrate the Lightning Network for faster transactions. Additionally, Block's point-of-sale system, Square, now allows merchants to accept Bitcoin payments. The company has also launched Bitkey, a hardware wallet designed to simplify Bitcoin self-custody. Block's long-term vision is to provide a comprehensive "Bitcoin banking suite" for small businesses, making Bitcoin treasury tools accessible to a broader audience.

Link: https://bitcoinmagazine.com/business/jack-dorseys-block-inc-is-reinventing-finance-bitcoin

Adam Back’s $2.1B Bitcoin Treasury Play Set to Challenge MARA in BTC Holdings.

Summary: According to reports, Bitcoin pioneer Adam Back's company, Bitcoin Standard Treasury (BSTR), is preparing to go public on Nasdaq after merging with Cantor Equity Partners. The company currently holds over 30,000 BTC and aims to increase its holdings to more than 50,000 BTC. If successful, this move would position BSTR as the second-largest corporate holder of Bitcoin, challenging MARA Holdings. The strategy is to emulate the model of Michael Saylor's MicroStrategy by using the acquired company as a vehicle for building a large Bitcoin treasury.

Link: https://www.coindesk.com/markets/2025/08/16/adam-back-s-usd2-1b-bitcoin-treasury-play-set-to-challenge-mara-in-btc-holdings

Strategy Acquires 155 BTC and Now Holds 628,946 BTC.

Summary: Strategy, formerly MicroStrategy, announced the purchase of an additional 155 Bitcoin for approximately $18 million. This acquisition, made at an average price of $116,401 per Bitcoin, brings the company's total holdings to 628,946 BTC. The company's cumulative investment is now about $46.09 billion, with an average price of $73,288 per coin. This latest buy marks the fifth anniversary of Strategy's Bitcoin treasury strategy and reinforces its position as the world's largest corporate holder of Bitcoin.

Link: https://www.strategy.com/press/strategy-acquires-155-btc-and-now-holds-628946-btc_08-11-2025

US Treasury’s Bessent backpedals: Bitcoin buying still possible.