Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

💰 Bitcoin is rapidly moving into the mainstream, fueled by increasing institutional and corporate adoption. Public companies are adding Bitcoin to their balance sheets, with corporate holdings recently crossing 1 million BTC for the first time. The approval and success of Bitcoin ETFs have also been a major catalyst, attracting over $55 billion in a year and a half and providing traditional investors with a new on-ramp. This growing interest is seen by some, like venture capitalist Tim Draper, as a "historic rush," with states and governments now considering Bitcoin as a strategic reserve.

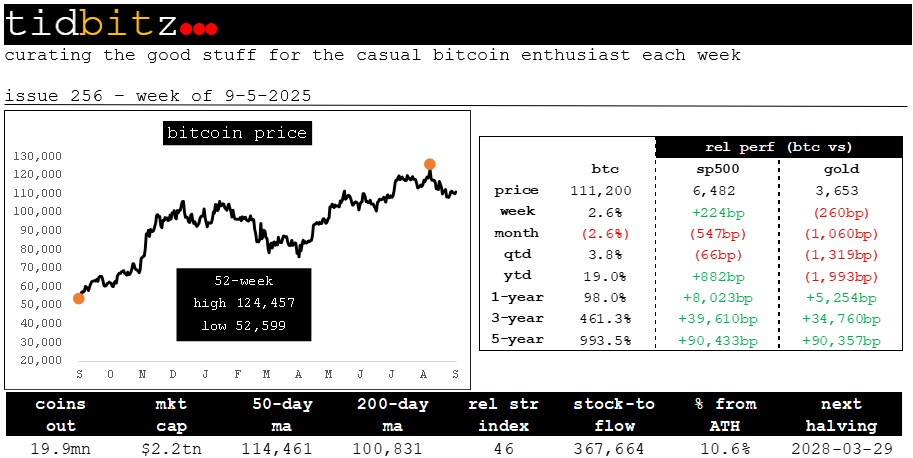

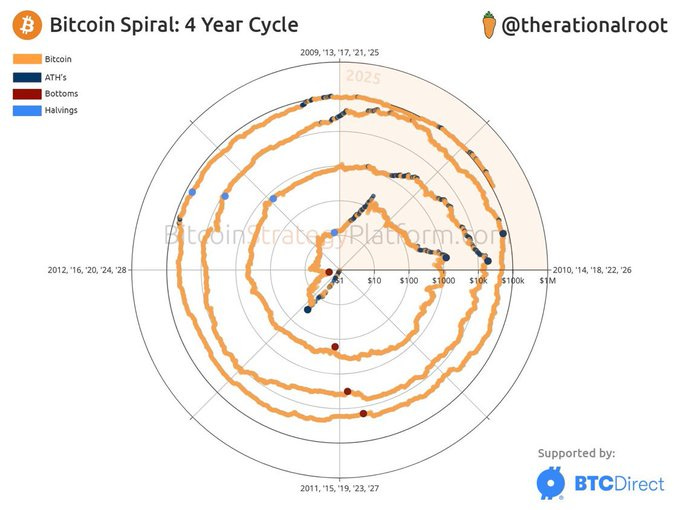

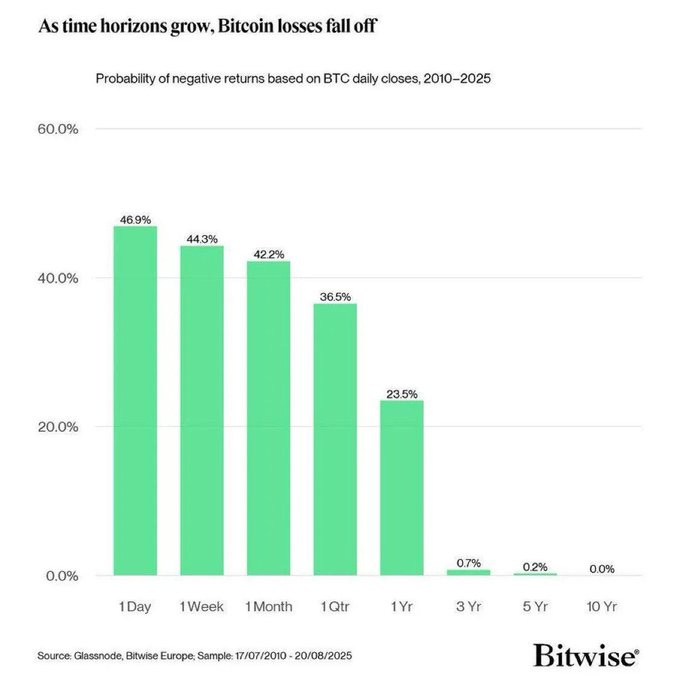

📈 The market's dynamics show a maturing asset with increasing stability and a sustained bullish outlook. Bitcoin's mining difficulty has hit an all-time high, signaling a more secure and competitive network. Despite this, the asset's volatility has decreased, and corrections have become shallower compared to past cycles, with its volatility at times being lower than that of traditional assets like gold. These factors, combined with strong demand, have led to bullish price predictions, with some analysts forecasting the price to reach $250,000 or even higher in the coming years.

🛡️ Bitcoin's increasing adoption is also a response to the current macroeconomic climate of rising global debt, inflation, and a weakening US dollar. Many view Bitcoin as a necessary hedge against these pressures, positioning it as a fundamental solution to what they see as a flawed fiat monetary system. Proponents argue that Bitcoin represents a "separation of money and state," a monumental shift that could empower individuals and provide a tool against authoritarianism. The core principle of Bitcoin's 21 million supply cap ensures its incorruptible scarcity, which is considered its most valuable trait.

Does Bitcoin Belong on Your Balance Sheet?

Summary: Based on the information available, the article from the Harvard Business Review explores how corporations should approach holding Bitcoin. The article suggests that CEOs, CFOs, and treasurers should view Bitcoin as both a network for moving money and an asset. It advises that for most corporations, holding a small percentage of Bitcoin is a sensible strategy due to its volatility. The article recommends that leaders focus on two key factors when making an investment decision: Bitcoin's share of store-of-value demand relative to monetary gold and high-quality sovereign debt, and evidence that the Bitcoin network is moving payments at a large scale.

Link: https://hbr.org/2025/09/does-bitcoin-belong-on-your-balance-sheet

Bitcoin Price Surges Above $111,000 As Strategy Buys $449 Million Worth Of BTC.

Summary: Based on the provided article, Bitcoin's price recently surged past $111,000, driven by a major acquisition from the company Strategy. According to a recent SEC filing, Strategy bought an additional 4,048 Bitcoin for nearly $450 million, bringing their total holdings to over 636,000 BTC. This significant purchase, funded by recent at-the-market offerings, highlights a growing trend of corporate treasury departments adopting Bitcoin. The article suggests this corporate accumulation, along with acquisitions from other companies, indicates increasing institutional acceptance of Bitcoin.

Link: https://bitcoinmagazine.com/markets/bitcoin-price-surges-above-111000-as-strategy-buys-449-million-worth-of-btc

Why Athletes Are Turning $10 Million Paydays Into Bitcoin.

Summary: Professional athletes are increasingly converting their salaries into Bitcoin for a variety of reasons. This trend is driven by Bitcoin's potential for significant long-term growth and its ability to act as a hedge against inflation, which helps secure their wealth beyond their typically short careers. Additionally, Bitcoin's global portability and decentralized nature appeal to athletes who frequently travel or work in different countries. The adoption also reflects a cultural alignment with financial independence, a value that resonates with many younger athletes and their fans.

Link: https://bitcoinmagazine.com/sponsored/why-athletes-are-turning-10-million-paydays-into-bitcoin

Where Will Bitcoin's Price Be in 2030?

Summary: Financial predictions for Bitcoin in 2030 vary significantly, with some forecasts suggesting a price of over $140,000. These projections are often based on the assumption of continued growth and wider adoption of the cryptocurrency. However, it's important to remember that such predictions are speculative and Bitcoin's future value is not guaranteed. Factors like market volatility, regulatory changes, and competition from other digital assets could all influence its price.

Link: https://www.fool.com/investing/2025/09/04/where-will-bitcoin-price-be-in-2030/

Tether denies Bitcoin sell-off rumors, confirms buying BTC, gold, land.

Summary: Tether has addressed and denied rumors that it was selling off its Bitcoin holdings. The company stated that it continues to invest its profits into "safe assets" including Bitcoin, gold, and land. A decrease in Tether's reported Bitcoin holdings was due to a transfer of funds to a separate financial platform, not a sell-off. This clarification highlights Tether's ongoing strategy of allocating its profits to diversify its asset portfolio.

Link: https://cointelegraph.com/news/tether-denies-bitcoin-sell-off-invests-btc-gold-land

Bitcoin network mining difficulty climbs to new all-time high.

Summary: Bitcoin mining difficulty has reached an all-time high of 134.7 trillion, making it more challenging for miners to operate profitably. This trend has raised concerns about the centralization of Bitcoin mining, as the high costs favor large corporations over individual miners. Despite these challenges, some solo miners have still managed to successfully mine blocks. These solo miners were able to claim the full block reward of 3.125 BTC, which is currently valued at over $344,000.

Link: https://cointelegraph.com/news/bitcoin-mining-difficulty-all-time-high

Early Tesla investor Tim Draper says not owning Bitcoin is “irresponsible.”