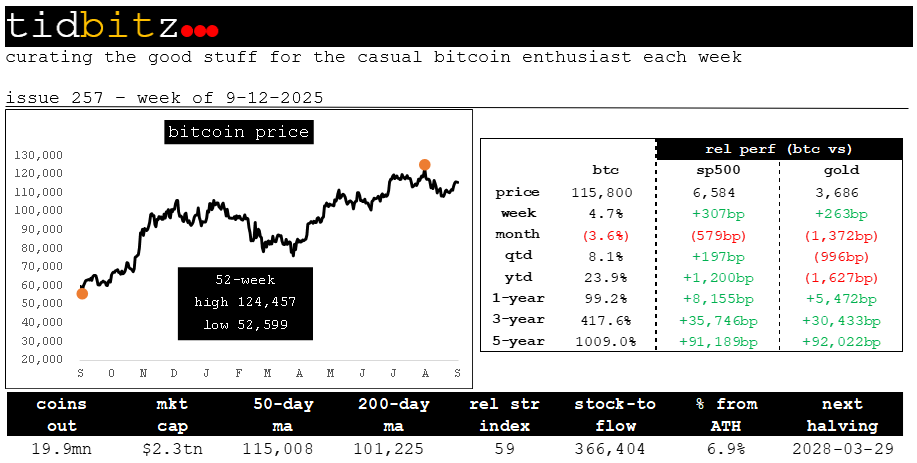

issue 257 - week of 9-12-25

curating the good stuff for the casual bitcoin enthusiast each week

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

📈 Bitcoin has undergone a significant transformation, evolving from a speculative asset to a recognized form of "digital capital," as highlighted by Michael Saylor, with institutional adoption surging as evidenced by the increase in publicly listed companies holding Bitcoin from 60 to 180 in a year, with projections of reaching 700. Spot Bitcoin ETFs, described as the most successful in Wall Street history, hold 1.5 million Bitcoin and serve as critical entry points for large capital pools, including pension funds and sovereign wealth funds, while governments are shifting toward a more favorable stance, with some embracing Bitcoin and stablecoins as strategic assets. This institutional and governmental acceptance is driven by Bitcoin’s fixed supply and decentralized nature, positioning it as a hedge against fiat currency debasement and a potential "digital gold," with figures like Tyler Winklevoss comparing it to "gold 2.0."

🚀 The bullish outlook for Bitcoin is fueled by macroeconomic factors and its unique market dynamics, with price predictions ranging from $200,000 by 2025 (Tom Lee) to $1 million within a decade (Tyler Winklevoss) and even $10 million in seven years (Eric Yakes), supported by anticipated Federal Reserve rate cuts and a strong correlation between Bitcoin’s price and global liquidity metrics like M2 money supply and stablecoin supply. Bitcoin’s fixed supply and the "mass movement" behind it, as described by Eric Yakes, create an inelastic supply dynamic that could drive significant price appreciation, further reinforced by a 92.42% correlation with gold prices, solidifying its "digital gold" narrative. However, concerns about market volatility, leverage in Bitcoin treasury companies like MicroStrategy, and the risks of rehypothecation in lending platforms highlight the speculative and financial engineering challenges within the ecosystem.

🚧 Despite its potential, Bitcoin faces significant risks and challenges, including the possibility of government nationalization, as warned by Willy Woo, and centralization risks, particularly with custodial ownership by exchanges like Coinbase, which could undermine Bitcoin’s permissionless ethos. Regulatory uncertainties and the potential for a "KYC-only" future threaten Bitcoin’s role as "freedom money," while Dave Collum’s concerns about a "complacency bubble" in traditional markets and distrust in the Federal Reserve underscore the broader economic instability driving Bitcoin’s appeal. Looking ahead, Bitcoin could redefine the financial system, incentivizing long-term thinking and potentially leading to a "free banking" world where stablecoins backed by Bitcoin challenge traditional central banking, though its ultimate trajectory—whether as a geopolitical asset, a neutral global currency, or a controlled store of value—remains uncertain.

“Bottom of the first inning.” Winklevoss twins see bitcoin reaching $1,000,000 in 10 years

Summary: The Winklevoss twins, prominent cryptocurrency investors, predict that Bitcoin could reach $1 million within the next decade, driven by increasing global adoption and its potential to rival gold as a store of value. They argue that Bitcoin's fixed supply and decentralized nature make it an attractive hedge against inflation and government-controlled currencies. The twins also highlight the growing institutional interest and infrastructure development in the crypto space as key catalysts for this bullish outlook. However, their prediction faces skepticism due to Bitcoin’s volatility and regulatory uncertainties.

Link: https://www.cnbc.com/2025/09/12/winklevoss-twins-see-bitcoin-reaching-1000000-in-10-years.html

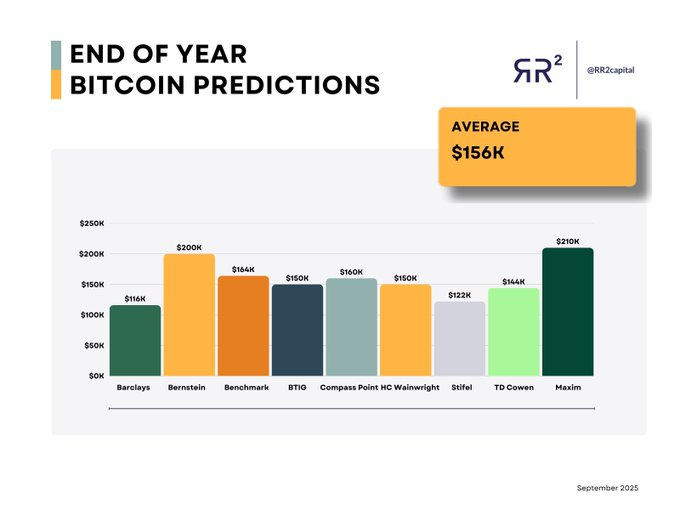

Bitcoin Could Hit $200K by Year-End Says Fundstrat's Tom Lee.

Summary: Fundstrat Global Advisors' Tom Lee predicts that Bitcoin could reach $200,000 by the end of the year. The primary driver for this forecast is the potential for Federal Reserve interest rate cuts, which would increase market liquidity and create a favorable environment for risk assets like Bitcoin. The article notes that markets are anticipating at least a 25-basis-point rate cut at the upcoming Fed meeting. Lee's prediction is also supported by historical fourth-quarter seasonality, which often sees Bitcoin's price appreciate.

Link: https://coinmarketcap.com/academy/article/bitcoin-could-hit-dollar200k-by-year-end-says-fundstrats-tom-lee

Parabolic Bitcoin Rally Is Coming—Here’s What to Watch.

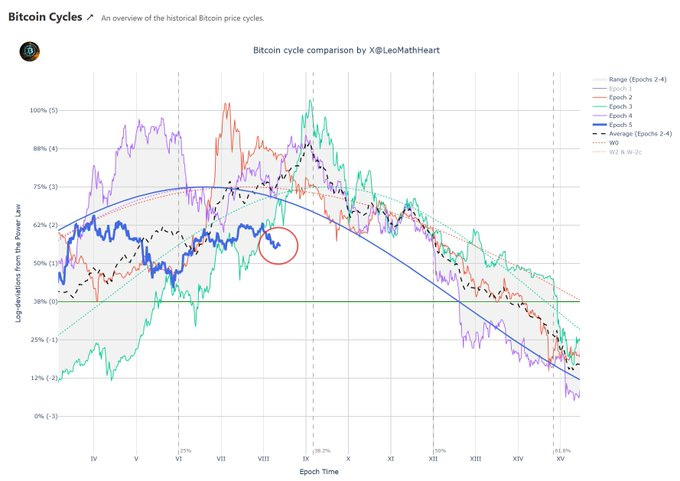

Summary: This article suggests that a "parabolic Bitcoin rally" is still possible despite arguments that institutional adoption would lead to more stable market cycles. The author contends that the belief that "this time is different" underestimates the role of human psychology and historical market behavior, noting that even sophisticated investors are susceptible to emotional biases. The article references Bitcoin's tight supply and ETF flows to support its claim, projecting a potential price of over $220,000. It concludes by arguing that the next rally could be more dramatic than previous ones, as historical patterns and Bitcoin's unique dynamics are being overlooked.

Link: https://bitcoinmagazine.com/markets/parabolic-bitcoin-rally

Bitcoin trader says ‘Time to pay attention’ to $115K BTC price.

Summary: This article reports on Bitcoin's price movement toward $115,000 ahead of a key Federal Reserve interest rate decision. According to traders like Skew and Rekt Capital, a weekly close above $114,000 is needed to maintain a "bullish" outlook. The market is anticipating a rate cut of at least 0.25%, supported by positive U.S. macro data. This combination of improving economic indicators and looser financial conditions could create a favorable trading environment for risk assets, including Bitcoin.

Link: https://cointelegraph.com/news/bitcoin-trader-time-to-pay-attention-115k-btc-price

These 3 Signals Statistically Predict Bitcoin’s Next Big Move.

Summary: Three key signals can be used to predict Bitcoin's next major price movement: Global Liquidity, stablecoin supply, and the price of gold. The article highlights that stablecoin supply has the strongest correlation with Bitcoin's price, as large minting of stablecoins acts as "dry powder" for investment. It also notes a surprising correlation with the price of gold, where Bitcoin tends to mirror gold's movements after a 10-week lag. The author concludes that while Bitcoin may consolidate in the short term, a continued expansion of stablecoin supply and a breakthrough in gold's price could lead to a powerful year-end rally.

Link: https://bitcoinmagazine.com/markets/3-signals-predict-bitcoin-big-move

BlackRock weighs ETF tokenization as JPMorgan flags industry shift: Report.