issue 259 - week of 9-26-25

curating the good stuff for the casual bitcoin enthusiast each week

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

💻 The current state of Bitcoin is characterized by intense internal developer debate and profound external macroeconomic forces driving financial innovation. Internally, a “civil war” between Bitcoin Core and Bitcoin Knots centers on whether the network should strictly enforce a monetary-only purpose by filtering what Knots proponents deem “spam,” a move critics argue actively harms scaling solutions like the Lightning Network and mining decentralization. This technical dispute highlights a broader crisis of trust in development stewardship and has led to mempool fragmentation, where different clients see conflicting sets of unconfirmed transactions.

💸 Simultaneously, Bitcoin’s long-term trajectory is being dictated by the deteriorating global macroeconomy, particularly the U.S. debt spiral. Analysts contend that the Federal Reserve is being forced toward a “third mandate” of financial repression—maintaining artificially low long-term rates to ensure government solvency, a policy akin to Yield Curve Control (YCC). This monetary debasement is expected to severely devalue the dollar and traditional fixed-income assets, positioning Bitcoin as the primary hedge; indeed, the appointment of an aggressively “dovish” Fed Chair is seen as the “biggest bull catalyst,” with the potential to trigger a “blow-off top” toward a $200,000 to $1 million price target.

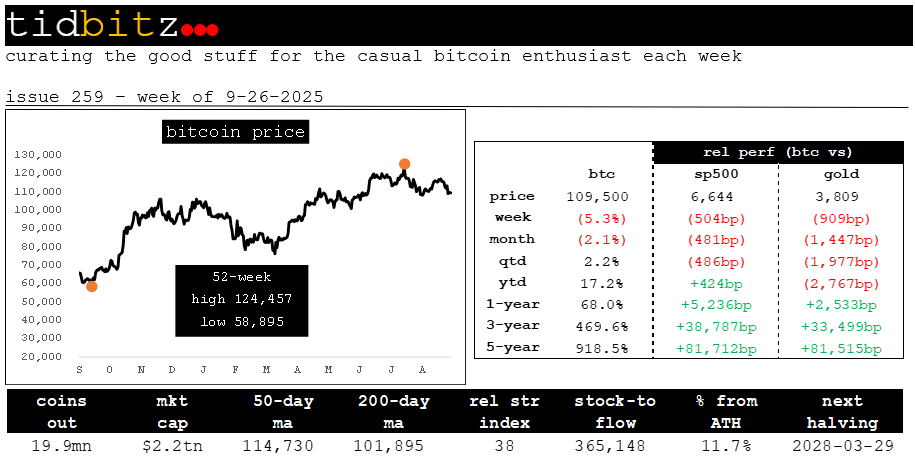

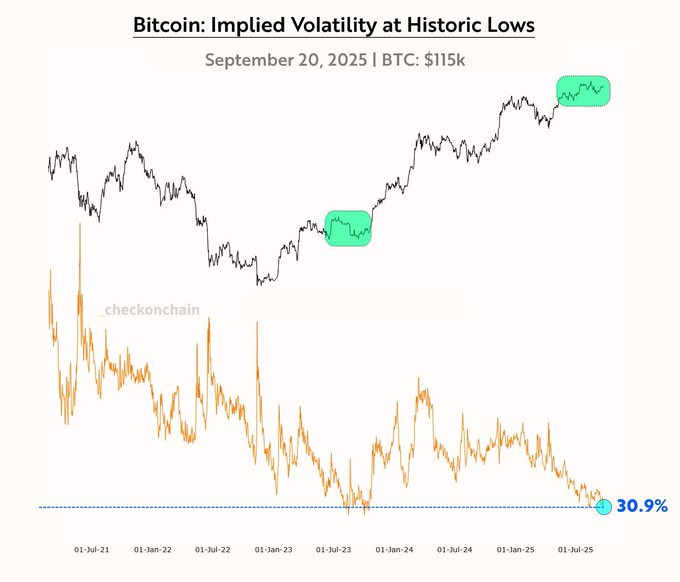

📈 This environment is fueling a wave of financialization and market maturation, exemplified by the rise of Bitcoin Treasury Companies like MicroStrategy. These firms utilize convertible debt and perpetual preferred equity to build a “Bitcoin war chest,” effectively disrupting the $300 trillion fixed-income market by offering higher-yield, digitally-backed credit. The introduction of derivatives and consistent capital inflows from these corporate treasuries are absorbing the selling pressure from long-term holders, creating a period of price stability that analysts believe precedes a decisive move toward a $10 trillion market capitalization as the traditional financial system continues its structural breakdown.

Coinbase CEO Says Bitcoin Could Hit $1 Million by 2030 — If Banks Don’t Get in the Way.

Summary: Coinbase CEO Brian Armstrong predicts that Bitcoin could reach $1 million by 2030, provided that policymakers prevent traditional banks from obstructing the crypto industry’s growth. He attributes his optimism to key demand drivers, including increasing regulatory clarity, U.S. government Bitcoin reserves, and wider ETF adoption. Armstrong warns that big banks are actively lobbying against progress, specifically targeting crypto rewards programs that threaten their profitable credit card industry. For Armstrong, this conflict exposes a deeper ideological battle between legacy, closed financial systems and the open, cost-effective infrastructure offered by Bitcoin and stablecoins.

Link: https://bitcoinmagazine.com/takes/coinbase-ceo-says-bitcoin-could-hit-1-million-by-2030-if-banks-dont-get-in-the-way

Bitcoin Core vs. Bitcoin Knots: Actions Speak Louder Than Words.

Summary: The debate between Bitcoin Core and Bitcoin Knots centers on the true purpose of the Bitcoin network, with Knots claiming to champion decentralization and its use as censorship-resistant money. However, critics argue that the actions of Knots supporters, such as the proprietary DATUM protocol developed by the OCEAN mining pool, actually work against mining decentralization. Furthermore, the latest Knots release defaults to filtering essential transactions needed for Layer 2 scaling solutions like Lightning and Citrea, undermining Bitcoin’s growth as a monetary network. This discrepancy between the stated values of Knots proponents and their technical implementation has led to accusations that their software actively works toward the opposite of their proclaimed goals.

Link: https://bitcoinmagazine.com/culture/bitcoin-core-vs-bitcoin-knots-actions-speak-louder-than-words

Options and derivatives to take Bitcoin to $10T market cap: Analyst

Summary: Market analyst James Van Straten argues that financial derivatives, such as options contracts, will be the catalyst that drives Bitcoin’s market capitalization to at least $10 trillion. These financial instruments are crucial because they attract large institutional investors and help cushion the market against the high volatility typically associated with digital assets. Evidence for this shift includes the all-time high open interest for BTC futures on the Chicago Mercantile Exchange, which indicates a systematic adoption of volatility selling strategies like covered calls. Although reduced volatility may also dampen the extreme price gains, Van Straten views this as a sign of a more mature market structure with deeper liquidity for Bitcoin.

Link: https://cointelegraph.com/news/options-derivatives-bitcoin-10t-market-cap

The Real Reason The Bitcoin Price Can’t Go Higher.

Summary: Bitcoin’s price is currently pinned in a tight trading range, lagging behind rallies in equities, gold, and other major commodities since early July. This stability is due to a tug of war between supply and demand, with a limited number of long-term holders (”whales”) realizing profits and transferring large amounts of Bitcoin. However, the selling pressure from these whales is being fully absorbed by steady, growing institutional demand, primarily through Bitcoin ETFs and corporate treasury allocations. This unusual market equilibrium, where institutional accumulation offsets whale distribution, is keeping the price from collapsing or surging. A major breakout may occur if other asset classes become stretched at their highs, causing capital to rotate into Bitcoin as the next target.

Link: https://bitcoinmagazine.com/markets/bitcoin-price-cant-go-higher

Morgan Stanley to Enable Bitcoin Trading for E*Trade Clients in First Half of 2026.

Summary: Morgan Stanley is planning a major move into the digital asset space by enabling direct spot Bitcoin and crypto trading for its E*Trade retail clients. This service, which will initially include Bitcoin, Ethereum, and Solana, is expected to go live in the first half of 2026, leveraging a partnership with infrastructure provider Zerohash for custody and settlement. The initiative is a significant step for a major Wall Street bank, aiming to integrate traditional and digital assets within the same brokerage accounts and signaling a broader industry shift toward mainstream crypto adoption.

Link: https://bitcoinmagazine.com/news/morgan-stanley-to-enable-bitcoin-trading-for-etrade-clients-in-first-half-of-2026

Bitcoin’s “biggest bull catalyst” may be the next Fed chair pick: Novogratz