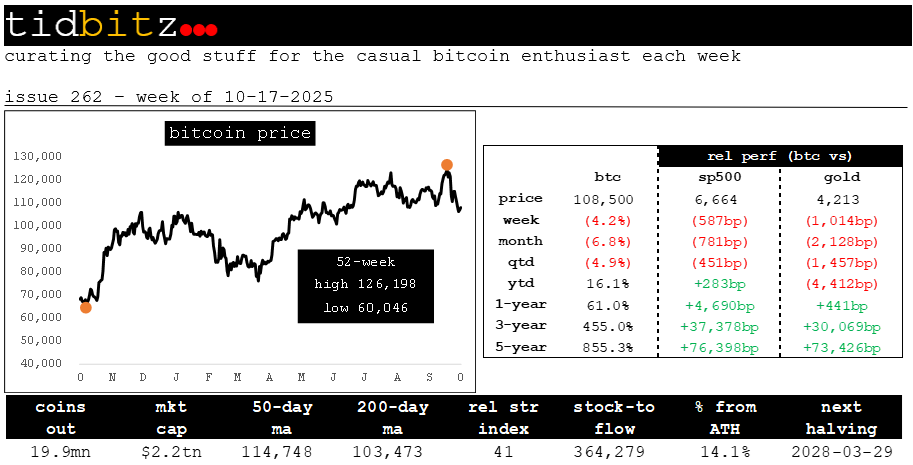

issue 262 - week of 10-17-25

curating the good stuff for the casual bitcoin enthusiast each week

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

news

I used Google NotebookLM and Gemini to summarize the information in this week’s news links:

💥 A severe deleveraging event, primarily driven by the altcoin market, has reset cryptocurrency market dynamics, with a flash crash triggering an estimated $20 billion in liquidations and wiping out 1.6 million traders. This event exposed the fragility of altcoins, described as “FTX-level carnage,“ as market-maker liquidity vanished, revealing a lack of fundamental bids, with some tokens crashing to zero before recovering. Bitcoin, while hit with $2.4 billion in long liquidations and a 25% drop in futures open interest, showed relative resilience, stabilizing 12% below its all-time high. Analysts view this as a healthy purge of speculative leverage, strengthening Bitcoin’s market footing, while raising concerns about the institutional viability of altcoins, with the crisis potentially fostering a new wave of Bitcoin maximalists wary of counterparty risk and illiquidity.

💰 The macroeconomic context amplifies this market shock, characterized by a “reverse crash” where rising hard asset prices, particularly gold, mask a declining standard of living due to fiat currency debasement. Gold’s outperformance over Bitcoin is attributed to its deep integration with central banks and Bitcoin’s internal debates, which may deter institutional investors. On-chain data indicates extreme fear, with metrics like the Fear & Greed Index and NUPL signaling oversold conditions, yet strong spot buying on Binance ($309 million net taker volume) suggests accumulation and a potential market bottom. Key Bitcoin price levels include $118,000 (point of control), $114,000 (short-term holder cost basis), and $95,000 (a critical support dubbed the “bull’s last stand“).

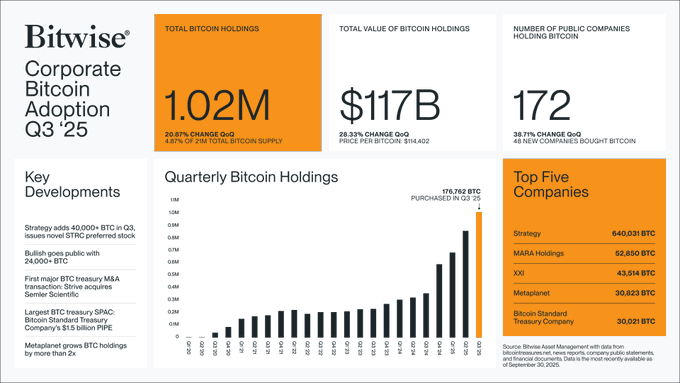

🏦 Despite the volatility, institutional and sovereign adoption of Bitcoin is accelerating. Charles Schwab reported a 90% surge in crypto platform visits and plans spot Bitcoin trading by 2026, while Morgan Stanley and U.S. Bank are expanding crypto services. The U.S. government is amassing significant Bitcoin holdings through seizures, including a $15 billion forfeiture, and has established a Strategic Bitcoin Reserve. Nation-state interest is growing, with discussions involving multiple central banks, potentially positioning Bitcoin as a global financial asset akin to Special Drawing Rights. Analysts suggest Bitcoin’s dip may signal broader market shifts, with its role as a leading indicator contrasting gold’s established reserve status, setting the stage for a potential wave of adoption in 2026.

Charles Schwab Sees 90% Spike in Crypto Interest, Plans Spot Bitcoin Trading in 2026.

Summary: Charles Schwab has reported a significant 90% year-over-year surge in visits to its crypto platform, signaling strong retail investor demand for crypto-related products like Bitcoin ETFs and futures. Clients of the firm now hold approximately 20% of all crypto Exchange-Traded Products (ETPs) in the U.S. In response to this growing interest, CEO Rick Wurster announced that Charles Schwab plans to offer spot Bitcoin trading in the first half of 2026. This move comes alongside the firm’s broader record-breaking quarter, which saw total client assets reach $11.59 trillion.

Link: https://bitcoinmagazine.com/markets/charles-schwab-spike-in-crypto-interest

Investors Pile In After Bitcoin’s Decline — Here’s What It Could Mean.

Summary: Despite Bitcoin’s price correction below $105,000, on-chain data indicates a strong bullish undercurrent, with net taker volume on Binance spiking to $309 million. This high net taker volume, representing immediate market-price buying, suggests investors are aggressively accumulating the asset during the price weakness. The divergence from open interest, which failed to rise in tandem, reinforces that the buying is concentrated in the spot market rather than in leveraged derivatives. Analysts view this aggressive spot accumulation around key liquidity levels as a potential foundation for a parabolic price rebound once the current selling pressure subsides.

Link: https://www.tradingview.com/news/newsbtc:1184ad423094b:0-investors-pile-in-after-bitcoin-s-decline-here-s-what-it-could-mean/

Analyst Warns Gold Trade “Overheated,” Says Capital Could Rotate To ‘Undervalued’ Alternatives, Including Bitcoin.

Summary: The CEO of The Coin Bureau, Nick Puckrin, has warned that the gold trade is likely “overheated” following its recent record-breaking price run. Puckrin suggests that the asset’s current performance and the extreme institutional positioning signal a potential peak in gold’s momentum. He believes that as capital begins to exit this crowded trade, it will seek out “undervalued” alternatives in the market. Consequently, the analyst points to assets like Bitcoin as a prime destination for this rotating capital, which could fuel a significant rally in the cryptocurrency.

Link: https://finance.yahoo.com/news/analyst-warns-gold-trade-overheated-010114574.html

John Bollinger Warns of Imminent Bitcoin Volatility Shift.

Summary: Renowned technical analyst John Bollinger has issued a warning to traders to pay attention, signaling an imminent shift in Bitcoin’s volatility after the asset’s Bollinger Bands recently widened. Bollinger, however, noted that the typically bullish “W” bottom reversal pattern has appeared on the charts for Ether and Solana, but not yet for Bitcoin. Despite Bitcoin’s sharp “V” shaped dip below $104,000, analysts maintain the asset is in an uptrend, pointing to the 50-week simple moving average (SMA) as a key historical support level. The historical context and technical indicators suggest that a significant price move, potentially a strong rebound, is anticipated following the current period of increased volatility and market fear.

Link: https://bitbo.io/news/bollinger-bitcoin-volatility-warning/

Bitcoin Price: 7 Vital On-Chain Signals Spotted From Recent Crash.

Summary: Following Bitcoin’s price dip below $105,000, prominent market analyst Burak Kesmeci identified seven vital on-chain signals that collectively point to a state of extreme fear and oversold conditions. Key metrics show the Fear and Greed Index plunged into the “extreme fear” zone, and the Net Unrealized Profit/Loss (NUPL) dropped below 50%, shifting market sentiment from optimism to worry. Furthermore, on-chain valuation indicators like the Advanced NVT Signal suggest the market is deeply oversold, a condition often seen during early bottom phases. These signals, combined with negative funding rates in the derivatives market, suggest that while fear is high, the present conditions may offer strong accumulation opportunities as a local market bottom could be forming.

Link: https://www.tradingview.com/news/newsbtc:128177cdd094b:0-bitcoin-price-7-vital-on-chain-signals-spotted-from-recent-crash/

DOJ seizes $15 billion in bitcoin from massive “pig butchering” scam based in Cambodia