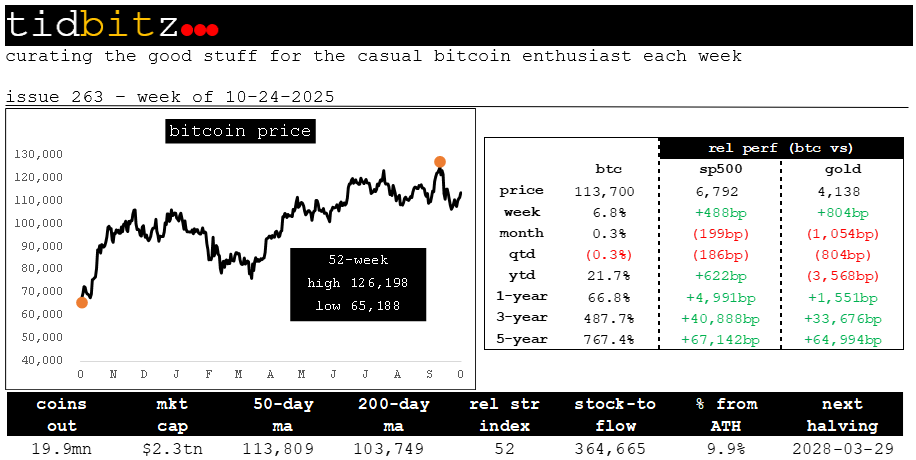

issue 263 - week of 10-24-25

curating the good stuff for the casual bitcoin enthusiast each week

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

summary

🚀 Beyond the Hype: 4 Bitcoin Realities That Will Reshape Your View of the Future

🔄 Introduction: The Shifting Bitcoin Narrative

For over a decade, Bitcoin has been defined in the public consciousness as a volatile, speculative asset, a digital wild west governed by cycles of extreme hype and crushing fear. 📈 Price charts, 😂 memes, and 📰 dramatic headlines have dominated the conversation, obscuring a more significant story unfolding just beneath the surface.

While the market obsesses over daily fluctuations, a series of profound structural, technological, and geopolitical shifts are quietly converging. These forces are fundamentally altering Bitcoin’s role in the world, moving it far beyond the realm of simple speculation. This article will explore four of the most surprising and impactful of these new realities, moving beyond the price charts to reveal the deeper currents that are reshaping our financial future.

💀 1. Forget What You Know: The Four-Year Cycle Is Dead

For years, Bitcoin market analysis was dominated by the “four-year cycle,” a theory that tied the asset’s dramatic bull and bear markets to the predictable supply shock of its halving events. This model suggested a recurring pattern: a post-halving surge, a parabolic peak roughly 18 months later, and a subsequent crash, all repeating with near-clockwork regularity.

That model is now considered obsolete by a growing consensus of market analysts, including Jeff Ross of Vailshire Capital Management, who argue that Bitcoin’s price action is no longer dictated by its internal supply schedule 📅 but is instead primarily driven by 🌍 global liquidity conditions and broader business cycles 💰. This shift marks a significant maturation of the asset, integrating it more deeply with the traditional financial world.

As a result, the predictable market tops and bottoms of the past are unlikely to repeat in the same way. Analysts who once pointed to late 2025 for a cycle peak are now looking toward a strong performance in 2026, aligning Bitcoin’s trajectory with macroeconomic trends rather than its own programmatic calendar.

This isn’t just a technical detail; it’s a fundamental change in Bitcoin’s character. It signals a maturing asset that is increasingly integrated with the global financial system, responding to the same macroeconomic forces that move traditional markets. For investors, it means the old playbook is obsolete, and a new, more nuanced understanding of global finance is required.

🐋➡️🏦 2. The Great Irony: Bitcoin Whales Are Moving to Wall Street

In one of modern finance’s great ironies, the very asset designed to exist outside the traditional banking system is now being purposefully and efficiently absorbed by it. The long-held ethos of “not your keys, not your coins” is giving way to the practical realities of Wall Street infrastructure, driven by a new class of financial products.

The key mechanism is the approval of “in-kind” creations for spot Bitcoin ETFs. This allows large holders, or “whales,” to deposit their privately held Bitcoin directly into a fund in a tax-neutral exchange for ETF shares. 🥶 These digital assets, once secured in cold storage, become regulated, reportable holdings on standard brokerage statements. BlackRock, the world’s largest asset manager, has already processed over $3 billion in such conversions for its IBIT fund.

This institutional integration isn’t limited to ETFs, however. 🤝 JPMorgan, whose CEO Jamie Dimon has a long history of publicly criticizing Bitcoin, now plans to allow institutional clients to use their direct Bitcoin and Ether holdings as collateral for loans. Crucially, the bank would store the assets through a third-party custodian, a structure that reflects how traditional finance is managing risk as it builds this new institutional architecture. The move signals a dramatic reversal, acknowledging the growing demand for crypto-collateralized financial services. Dimon himself has moderated his stance, reflecting the shifting institutional tide with a fitting analogy.

🚬 “I don’t think we should smoke, but I defend your right to smoke... I defend your right to buy Bitcoin, go at it.”

This trend is profoundly impactful. Longtime holders are trading a degree of self-custody for the undeniable utility of the traditional financial system: simplified leverage, streamlined estate planning, and easier access to collateralized loans. It marks a major new phase of integration, where Bitcoin’s core properties are being leveraged within the very system it was created to bypass.

🤖🤝₿ 3. The New Engine: The AI Boom and Bitcoin Are Fusing into a Single Macro Trade

Two of the most powerful technological trends of our time are beginning to collide. ⚡ On one side is Artificial Intelligence (AI), a beast that devours electricity and silicon faster than any industry in history. On the other is Bitcoin, the only monetary network that converts raw megawatts into incorruptible value. This is not a loose narrative; it is a structural fusion based on shared infrastructure and real-world cash flows, a collision between exponential compute and exponential scarcity.

The core dynamic is simple: AI’s exponential growth is creating an insatiable demand for electricity, the same fundamental resource that Bitcoin mining monetizes and secures. 🎡 This shared dependency is creating a powerful economic flywheel that strengthens both ecosystems simultaneously.

The process unfolds in a reinforcing loop:

📈 The AI buildout drives energy prices higher.

💸 Bitcoin miners, who control large-scale, flexible power infrastructure, can either sell their energy to AI data centers for a premium or continue mining Bitcoin with much fatter profit margins.

💪 This increased profitability funds the expansion of more mining and energy infrastructure, which in turn hardens the Bitcoin network.

🛡️ Corporate CFOs in the AI industry, witnessing this direct link, begin acquiring Bitcoin as a treasury hedge against volatile energy costs and to benefit from the network’s growth.

⬆️ This wave of corporate buying vacuums up more of Bitcoin’s finite supply, putting sustained upward pressure on its price.

A higher Bitcoin price inflates the value of miners’ equity, allowing them to finance even more energy infrastructure, which can then serve both AI and Bitcoin mining needs.

To put this in perspective, analysts are projecting that AI infrastructure capital and operating expenditures will hit $200 billion per year by 2027. A conservative 5% treasury hedge against that spending would create $10 billion in fresh spot demand for Bitcoin every single year. This fusion reaction, built on concrete, transformers, and fiber, could become one of the most significant drivers of Bitcoin’s value over the next decade.

⚔️ 4. The Real Threat: The Fiat End-Game Is a Geopolitical Showdown, Not Just an Economic Theory

For years, Bitcoin proponents have pointed to spiraling national debt and consumer price inflation as the primary catalysts for a “fiat endgame.” While those forces remain potent, a far more immediate and powerful driver is now unfolding on the world’s geopolitical stage, underscored by a shocking reality: 🤯 the United States fired 25% of its best missile interceptors in just under two weeks, and at current production rates, it will take a decade to replace them.

This vulnerability is the result of a thesis gaining traction among market observers: 🏭 China is using its near-monopoly on rare earth minerals and its dominance as the world’s factory to effectively disarm the U.S. military-industrial complex. This strategic dependency has left the United States unable to produce its own advanced weaponry at the scale and speed required for modern conflict.

The consequence is that the U.S. is being forced into an emergency, multi-decade “wartime” re-industrialization effort to regain its strategic independence. This is no longer a fringe theory but an assessment echoed at the highest levels of traditional finance. As JPMorgan CEO Jamie Dimon stated:

🚨 “It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products, and manufacturing. All of which are essential for our national security... We need to act now.”

The financial impact of this shift cannot be overstated. This massive industrial policy, framed as an “operation warp speed” for national security, will require an unprecedented level of money printing—what analysts are now calling 🖨️💵 “wartime financing.” This flood of new liquidity, driven by geopolitical necessity, is precisely the kind of macroeconomic force that analysts now see as the primary driver of Bitcoin’s price, dwarfing the old halving cycles. It makes the argument for a scarce, sovereign, and neutral reserve asset more urgent and concrete than ever before.

💡 Conclusion: A New Era of Money

Bitcoin is no longer a static picture to be debated; it has become an active engine at the heart of the global financial, technological, and geopolitical landscape. Its price is now being shaped not by niche halving cycles, but by mature macroeconomic forces. Its custody is moving from private wallets to the institutional heart of Wall Street. Its value is becoming intertwined with the AI revolution through a shared foundation of energy. And its ultimate necessity is being underscored by urgent geopolitical imperatives that demand a new financial reality.

These are not future predictions; they are ⛰️ tectonic plates already in motion. They represent a fundamental rewiring of the connections between technology, finance, and global power. As these plates continue to shift, the question is no longer if Bitcoin will be part of the future, but how the future will be rebuilt on top of it.

news

After A Decade Of Bitching About Bitcoin... JPMorgan Reportedly Plans To Allow Crypto As Collateral.

Summary: Despite over a decade of public criticism regarding cryptocurrencies from CEO Jamie Dimon, JPMorgan is reportedly planning to allow institutional clients to use Bitcoin and Ether as collateral for loans by the end of the year. This potential offering would require clients’ crypto holdings to be stored through a third-party custodian. If confirmed, this development represents a major shift that could make the two leading cryptocurrencies more attractive to large investors, following the historic approval of US spot Bitcoin exchange-traded funds (ETFs). The bank has gradually increased its crypto involvement, having launched JPM Coin in 2020 and reporting that it holds shares in spot Bitcoin ETFs, suggesting its strategy is pivoting away from Dimon’s long-held skepticism.

Link: https://www.zerohedge.com/crypto/after-decade-bitching-about-bitcoin-jpmorgan-reportedly-plans-allow-crypto-collateral

Analysts Set $200,000 Bitcoin Price Target – Is It Realistic By Christmas?

Summary: Multiple investment analysts have set a $200,000 Bitcoin price target by the end of 2025, with firms like Bernstein calling the forecast “conservative” given current market dynamics. This bullish outlook is primarily driven by the “watershed moment” of U.S. spot Bitcoin ETFs, which are expected to bring unprecedented structural demand from traditional capital pools. Analysts predict these ETFs could eventually hold about 15% of the total circulating Bitcoin supply by 2033, absorbing significant amounts of the asset. Furthermore, the forecast is underpinned by Bitcoin’s constrained supply following the latest Halving event, positioning the asset as a superior “store of value” alternative amid record U.S. debt and looming inflation threats.

Link: https://finance.yahoo.com/news/analysts-set-200-000-bitcoin-160000602.html

A Dip Below $100k “Seems Inevitable”, But StanChart Sees Bitcoin At $200k By Year-End.

Summary: Standard Chartered’s Geoffrey Kendrick maintains a highly bullish outlook on Bitcoin, forecasting a year-end price of $200,000, with a bear-case scenario still placing it “well north of $150,000.” Despite this aggressive target, Kendrick suggests a near-term dip below $100,000 is “inevitable” following a recent sell-off, which he views as a temporary liquidation event. He advises investors to “stay nimble” and be ready to buy this potential dip, asserting it “may be the last time Bitcoin is EVER below 100k,” as he expects a strong rebound. The anticipated momentum will be driven by continued inflows into Bitcoin ETFs and a rotation of capital from gold, which he notes recently outperformed Bitcoin but is now starting to reverse.

Link: https://www.zerohedge.com/crypto/dip-below-100k-seems-inevitable-stanchart-sees-bitcoin-200k-year-end

Japan Eyes Letting Banks Hold And Trade Bitcoin As Crypto Adoption Grows.

Summary: The Japanese Financial Services Agency (FSA) is reportedly considering major reforms to allow domestic banks to acquire and hold digital assets, including Bitcoin, for investment purposes. This move would reverse a conservative 2020 policy that prohibited banks from holding crypto due to concerns over volatility and financial stability. Under the proposed framework, banks would be able to trade digital assets similarly to stocks and bonds, with the FSA planning new safeguards and risk management protocols to mitigate the impact of price swings on banks’ balance sheets. This effort aims to create a safer environment for crypto investment, expand access to digital assets, and offer investors alternative avenues for returns amidst Japan’s significant economic challenges and high debt-to-GDP ratio.

Link: https://www.zerohedge.com/crypto/japan-eyes-letting-banks-hold-and-trade-bitcoin-crypto-adoption-grows

VanEck Mid-October 2025 Bitcoin ChainCheck.

Summary: The VanEck Mid-October 2025 Bitcoin ChainCheck report characterized Bitcoin’s recent pullback as a liquidity-driven mid-cycle reset, not the start of a bear market. It highlighted that global M2 money supply growth continues to explain more than half of Bitcoin’s price variance, reaffirming its role as an anti-money printing asset. A flush of futures leverage, which peaked before an 18% price drawdown in early October, has now normalized, suggesting the market correction has created a buying opportunity. Furthermore, rising on-chain activity and strong revenue-to-price correlations among Layer-1 blockchains point to the maturation of the digital asset class.

Link: https://www.vaneck.com/us/en/blogs/digital-assets/matthew-sigel-vaneck-mid-october-2025-bitcoin-chaincheck/

Bitcoin Whales Are Moving On-Chain Wealth Onto Wall Street Via BlackRock’s IBIT.

Summary: A quiet migration is occurring as Bitcoin’s wealthiest holders, often called whales, are moving their on-chain wealth from cold storage and self-custody onto Wall Street through traditional finance custodians. This shift is facilitated by the new “in-kind” mechanism for U.S. spot Bitcoin ETFs, which allows investors to deposit Bitcoin directly into a fund in exchange for shares without triggering a taxable event. By consolidating their holdings into regulated ETFs like BlackRock’s iShares Bitcoin Trust (IBIT), investors instantly gain benefits such as making the asset easier to borrow against, pledge as collateral, or include in estate planning. BlackRock has already processed over $3 billion in these conversions, highlighting the irony of the anti-establishment asset now being absorbed and integrated into the traditional banking and brokerage systems.

Link: https://bitcoinmagazine.com/business/bitcoin-whales-are-moving-on-chain-wealth-onto-wall-street-via-blackrocks-ibit

Bitcoin’s First Major Layer-2 in Nearly a Decade Goes Live With Arkade.