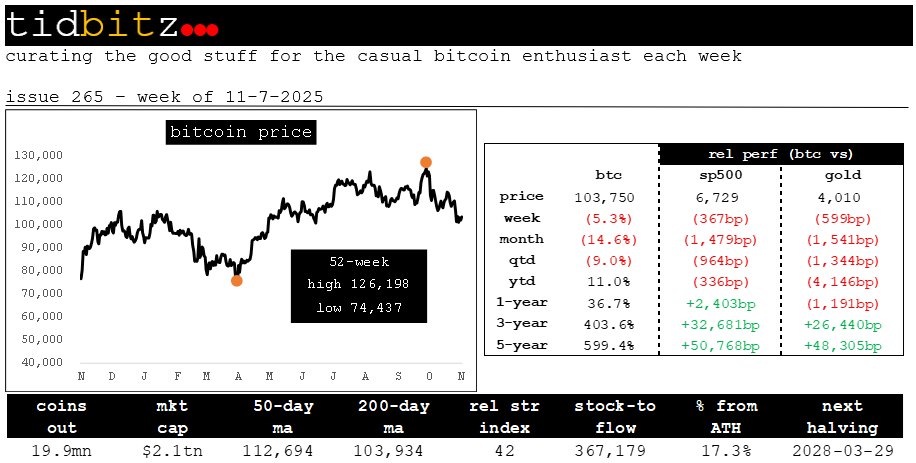

issue 265 - week of 11-7-25

curating the good stuff for the casual bitcoin enthusiast each week

Listen below for an succinct overview in podcast format of all items contained in this issue of the newsletter.

summary

🐻🐮The Most Bearish Bull Market Ever? Four Reasons Smart Money Disagrees🐻🐮

📉 The Great Disconnect

There is a mood of anxiety and frustration in the Bitcoin market. Despite a seemingly “risk-on” environment where assets like the S&P 500, Nasdaq, and gold are near all-time highs, Bitcoin has pulled back from its recent peak of $\sim\$126,000$ and entered a period of consolidation. For many, this has created a palpable cognitive dissonance. The price is now trading sideways around a new $100,000 plateau, and the successful launch of spot ETFs and growing institutional adoption have not delivered the parabolic run many expected.

🤔 This disconnect has left many retail investors exhausted and bearish. But what if this frustrating price action isn’t a sign of weakness, but a signal of a profound market shift and a deeply bullish setup? This post will explore four counter-intuitive takeaways from market experts that paint a very different, and much more optimistic, picture of what’s really happening.

Takeaway 1: Bitcoin is Having its ‘IPO Moment’ — And That’s a Good Thing

💼 Market commentators like Jordi Visser and Anthony Pompliano have described the current phase as Bitcoin’s “IPO Moment.” For the first time in its history, the massive, liquid demand from institutional players—channeled through ETFs from firms like BlackRock—is allowing very early Bitcoin holders (“OGs”) to realize some of their life-changing wealth.

💰 This isn’t a panic sell; it’s a natural distribution phase. It is akin to early employees and venture capitalists of a tech company selling a portion of their shares after a successful IPO. It is a sign of maturity and success, not failure. What is truly remarkable is that the price has managed to hold firm above $100,000 despite this massive, sustained selling pressure. Long-term holders have sold over 400,000 BTC in the last 30 days alone, yet this historic supply has been successfully absorbed by new institutional demand.

“Bitcoin is having its IPO moment and the whole idea is that you have the early holders of Bitcoin who are dispersing that Bitcoin into the market and there has been billions and billions and billions of dollars of sales of Bitcoin coming from those early holders yet the Bitcoin price is still at $100,000.”

🤝 This distribution is fundamentally healthy for the network. It’s a transfer of Bitcoin from a highly concentrated group of early adopters into stronger, more diversified institutional hands, creating a more robust and stable foundation for the future.

Takeaway 2: The Four-Year Cycle is Dead. Long Live the Macro Cycle.

🗓️ For years, the Bitcoin market has been defined by the “four-year cycle,” a theory that tied bull markets directly to the predictable four-year mining reward “halving.” This event would cut the new supply of Bitcoin in half, creating a supply shock that reliably kicked off a new price surge.

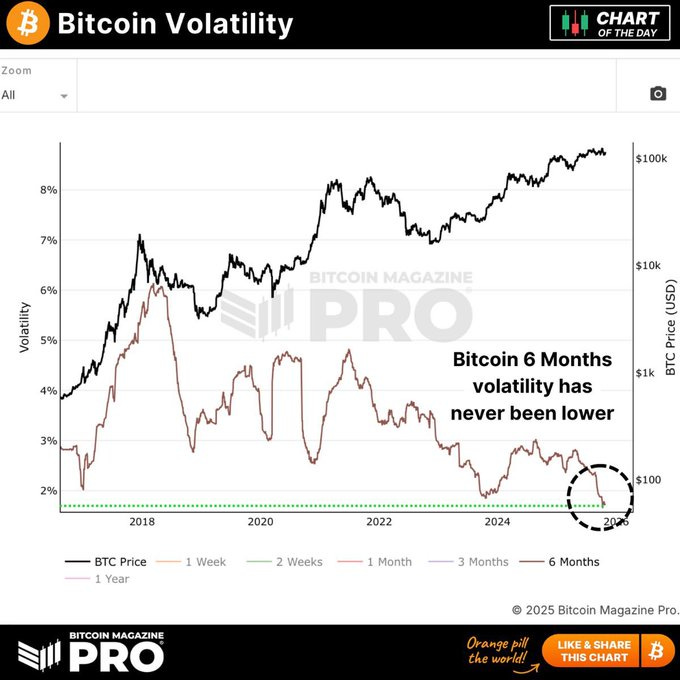

🌎 However, many experts, such as Lyn Alden, now believe this model is becoming obsolete. The new supply from mining is now a “negligible” or “much smaller component” of the market compared to the vast amount of existing Bitcoin available to trade. Bitcoin’s price is now primarily driven by factors of global macroeconomics: global liquidity, fiscal policy (government deficits), central bank actions (interest rates), and regulatory developments. In short, Bitcoin is now trading less on its internal schedule and more like the “macro asset that it is.”

⏳ This is a significant and counter-intuitive shift. It explains why this cycle feels so different and why many analysts believe it will be “longer than expected.” The old rules and timelines no longer apply, which is confusing market participants who are still looking at the old clock.

“...the last couple cycles it was kind of a blend of the having cycle and the liquidity cycle and so as basically we have the kind of the importance of one declining to the point where it’s almost negligible now and then those other factors kind of gradually increasing in prominence as they affect Bitcoin’s price...”

Takeaway 3: Retail is Exhausted, but Institutions are Just Getting Started

😔 The current market sentiment has been dubbed the “most bearish bull market ever.” Data from Lunar Crush reveals that retail sentiment is the “lowest and most bearish it has like almost ever been.” Similarly, the CIO of Bitwise, a major crypto asset manager, stated that retail investors are at “maximum desperation.”

📈 This retail exhaustion stands in stark contrast to the quiet but persistent institutional demand. The same Bitwise CIO noted that financial advisors are “still excited to allocate” to the asset class. Major Wall Street firms like JPMorgan have set bullish price targets, with one recent forecast targeting $170,000 in the next six to twelve months. BlackRock, in its own filings, has also reiterated its bullish long-term outlook.

🦉 This dynamic presents a classic “smart money” vs. crowd behavior scenario. While retail investors are being washed out by the frustrating sideways price action, large pools of institutional capital are methodically using this period as an accumulation phase.

“JP Morgan is more bullish on Bitcoin than Bitcoin Twitter is on Bitcoin.”

🧱 The nature of the primary buyer is shifting from short-term retail speculators to long-term institutional allocators. This suggests that a higher and far more stable price floor is being built, one supported by the deepest pockets in the financial world.

Takeaway 4: The Financial System’s Plumbing is Clogged, and the Fed is About to Open the Floodgates

🚨 Beyond Bitcoin’s internal dynamics, the broader macroeconomic picture reveals a traditional financial system showing serious signs of strain. In simple terms, several key indicators are flashing red. The reverse repo facility, a key tool for absorbing excess cash, is nearly empty. The Treasury General Account (TGA) has grown excessively due to the government shutdown, sucking liquidity out of the system. In response, key funding rates in the repo market have begun to spike.

🛑 These are serious red flags indicating that the system is starved of liquidity. This pressure is forcing the Federal Reserve to end its Quantitative Tightening (QT) policy, where it had been shrinking its balance sheet to fight inflation.

🗣️ Fed Chair Jerome Powell has explicitly acknowledged these pressures, noting they are similar to what occurred in late 2019—right before the Fed was forced to unleash a massive liquidity injection to prevent a market seizure.

“...reserves as a share of GDP stood near 8% of GDP in early 2019 prior to the acute funding pressures that emerged later that year.”

🌊 The implication for Bitcoin is massive. Market experts believe the Fed has “no choice” but to pivot back to money printing (Quantitative Easing, or QE) in the near future. This impending wave of liquidity is widely viewed as the primary catalyst that will fuel Bitcoin’s next major bull run.

Conclusion: The End of the Beginning

🌟 The current market frustration is masking a series of deeply bullish developments. The price action isn’t a sign of weakness but of maturation (the IPO moment). The old rules have changed as Bitcoin becomes a macro asset (the end of the four-year cycle). The buyers are stronger and have a longer time horizon (the rise of institutions). And a massive macro tailwind is building as the traditional financial system creaks under its own weight (the inevitable Fed pivot).

🚀 As Jack Mallers recently titled an episode, this period may be best understood as “The End of the Beginning” for Bitcoin—the final phase of its infancy before it becomes a fully mature global asset. Given the pressures building in the traditional financial system, the question may no longer be if Bitcoin will rally, but rather how profoundly it will reshape the financial landscape when the floodgates of liquidity finally open.

news

Institutions Stay Bullish on Bitcoin as Retail Capitulates: Bitwise CIO Sees Crypto Rally Ahead.

Summary: Despite the recent market turbulence that saw Bitcoin briefly dip below $100,000, Bitwise CIO Matt Hougan suggests the crypto market is nearing a bottom. Hougan notes that retail investor sentiment has reached “maximum desperation” following months of liquidations and market stress. In contrast, institutional investors and financial advisors remain optimistic about allocating capital to the asset class due to its strong long-term returns. Separately, Senator Cynthia Lummis continues to advocate for the integration of digital assets into the U.S. banking system, urging community banks to embrace custody and management of crypto. Hougan believes this divergence means institutional demand will soon take the lead, possibly fueling a year-end rally after the current retail “wash out” concludes.

Link: https://bitcoinmagazine.com/business/institutions-stay-bullish-on-crypto

JP Morgan Reveals Huge Bitcoin Bet As It Predicts A $3.5 Trillion Price Boom.

Summary: JPMorgan analysts have turned decidedly bullish on Bitcoin, predicting that the cryptocurrency could sharply rise to hit around $170,000 within the next 6 to 12 months. This optimistic forecast is based on the belief that a massive deleveraging phase, which cleared excess market leverage following recent sell-offs, is now largely complete. The bank’s model compares Bitcoin to “digital gold,” arguing that its improving volatility ratio compared to gold means it is trading significantly below its risk-adjusted fair value. Mechanically, this comparative analysis implies Bitcoin’s market capitalization could expand from its current $2.1 trillion to over $3.5 trillion, which underpins the $170,000 price target.

Link: https://www.forbes.com/sites/digital-assets/2025/11/08/jpmorgan-reveals-huge-bitcoin-bet-as-it-predicts-a-35-trillion-price-boom/

Strategy Announces Pricing of STRE Perpetual Preferred Stock

Summary: Strategy Inc. announced the pricing of its initial public offering of 7,750,000 shares of 10.00% Series A Perpetual Stream Preferred Stock (STRE). The shares were priced at €80.00 per share, leading to estimated net proceeds of approximately €608.8 million (or $702.2 million). Strategy intends to use the net proceeds from this offering for general corporate purposes, primarily including the acquisition of more Bitcoin. The STRE Stock will accumulate cumulative dividends at a fixed annual rate of 10.00% on a stated amount of €100 per share, payable quarterly.

Link: https://www.strategy.com/press/strategy-announces-pricing-of-strc-perpetual-preferred-stock_07-25-2025

BlackRock Reaffirms Bullish Bitcoin Stance Amid Price Stagnation.

Summary: BlackRock is maintaining a long-term bullish outlook on Bitcoin as a strategic asset, despite recent price stagnation around the $100,000 level. In a recent SEC filing, the asset manager emphasized that Bitcoin’s enduring relevance is driven by rapid global network adoption, increasing liquidity, and the declining credibility of traditional monetary systems. BlackRock’s own iShares Bitcoin Trust (IBIT) has been instrumental in institutional involvement, boasting over $80 billion in assets under management and outpacing inflows of competing Bitcoin ETFs. Ultimately, the firm sees Bitcoin as a vital global monetary alternative and a strategic hedge that is accelerating in value faster than its current price suggests.

Link: https://bitbo.io/news/blackrock-bitcoin-bullish-stance/

Tom Lee Says Bitcoin Can Still Reach $150,000 By Year End Despite “Uptober” Flop.